Of all the high frequency data the Personal Savings Rate is probably the least reliable. It is subject to both regular and benchmark revisions that can change the estimates drastically one way or the other. One step up from that statistic is the figures for Construction Spending. The initial monthly estimates don’t survive very long, and lately they have been quite weak in the first run only to be revised sharply higher over subsequent months.

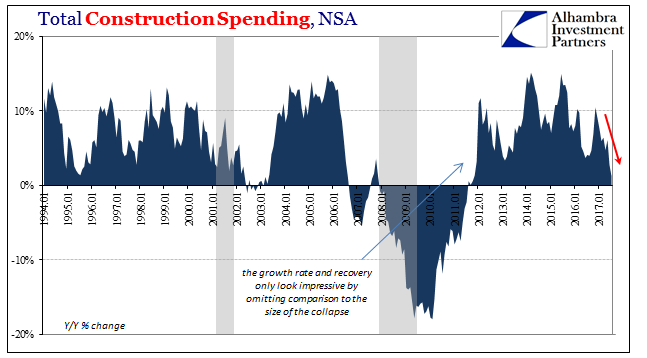

Even with the upward revisions, however, Construction Spending has turned unambiguously weak in 2017. The clear slowing no matter the monthly variation had been largely due to the public sector. Construction activity here peaked all the way back in June 2015, and has been on a downward trend since. That negative tendency has picked up in the last several months, including the latest estimates for July 2017.

For public sector activity, the reasons behind the slowdown were easy enough to figure and find. As an indirect reflection of the “rising dollar” downturn, government construction has been scaled back surely in response to slower growth in tax collections. State and local government taxes have been negatively affected by these macro conditions, so it would only make sense from a budget standpoint to equalize them in terms of major construction projects.

That was not the primary reason for the major slowdown in construction in July, though, merely continuing the weak public baseline contribution. Instead, it was a full contraction (at least in the initial estimate) in private non-residential construction that dragged the whole sector slower. Just seven months before, in December 2016 this part of the industry was growing at almost a 14% annual rate (year-over-year). The latest estimate for July is -4%, the first decline of any level since 2013, and the worst monthly result since 2011.

This type of construction is more closely associated with capex and productive business investment, the kind of economic activity that is badly needed to help pull the economy out of its stagnation. The question is why in 2017 has capex been scaled back so far (to an-as yet unknown degree)?

Leave A Comment