Gold investors were forewarned.

Gold bulls were shaken by the results of first round voting in France over the weekend. Bullion prices sank as much as 1.5 percent as the euro spiked two cents higher against the US dollar. While the far-right candidate, Marine Le Pen, advanced to the second round, her centrist opponent, Emmanuel Macron, is more likely to ultimately ascend to the presidency. Macron is pro-EU; Le Pen is not.

French voting wouldn’t have affected gold unless the market was primed for a fall. There were signs of wobbling in the days leading up to the vote.

First of all, a large net short position held by commercial producers and users had been building for weeks. For the first time since last November, the number surpassed 200,000 Comex contracts, approaching a five-year record.

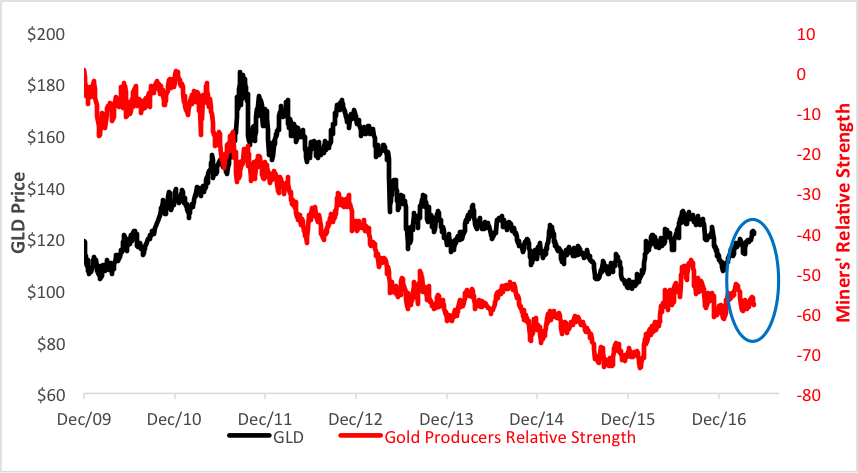

Then there’s the disparity between gold prices, proxied below by the SPDR Gold Shares Trust (NYSE Arca: GLD), and that of gold producers Mining stocks’ relative strength has been actually weakening as bullion itself was attracting buyers.

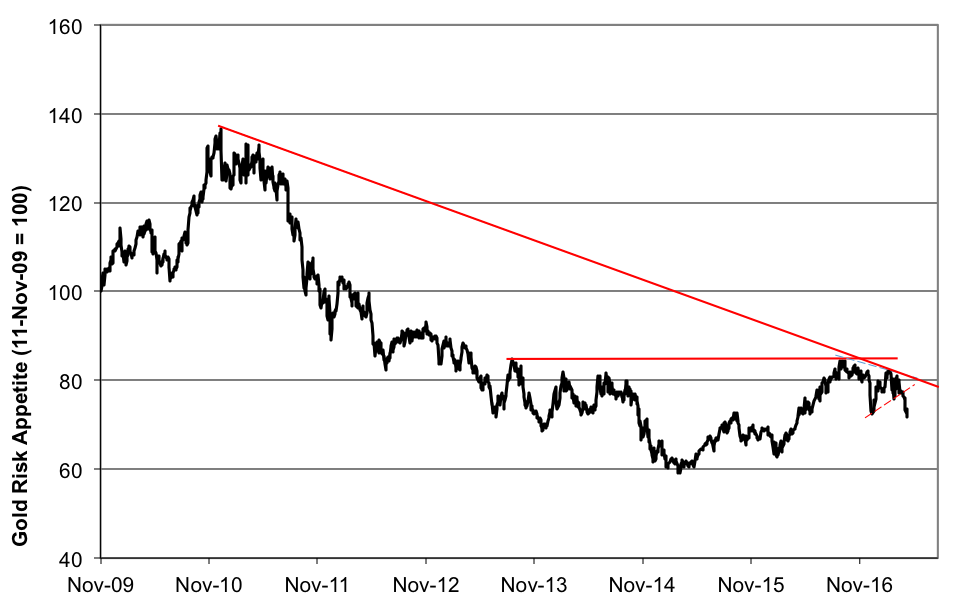

And, if you drill down into the mining sector, you’ll see risk aversion evident. We measure speculators’ risk appetite by comparing the price of the VanEck Vectors Gold Miners ETF (NYSE Arca: GDX) to that of the VanEck Vectors Junior Gold Miners ETF (NYSE Arca: GDXJ). Lately, as bullion prices rose amid mounting geopolitical tension, enthusiasm in the mining sector actually waned. We wrote about this phenomenon a couple of weeks ago (“Gold Miners Say Not Yet”).

Miners are bellwethers of bullion price movements – often establishing trends ahead of the gold market. It’s too early to foretell the degree of the current pullback but with the Frexit issue backburnered, investors are now more likely to look toward the trajectory of US interest rates for their gold cues. For most folk, that means waiting breathlessly on the next Fed meeting in early May.

Leave A Comment