For most of the past few years it was easy to make the case that precious metals mining stocks were cheap. They’d suffered through an epic bear market, and in some cases were down 90% or more from their 2011 highs. How much more could they fall?

But through it all, Sprott Asset Management’s Rick Rule — a voice of reason in this frequently-unreasonable sector — was warning investors off of the miners, saying that “capitulation” hadn’t yet occurred and until it did there remained way too much downside risk.

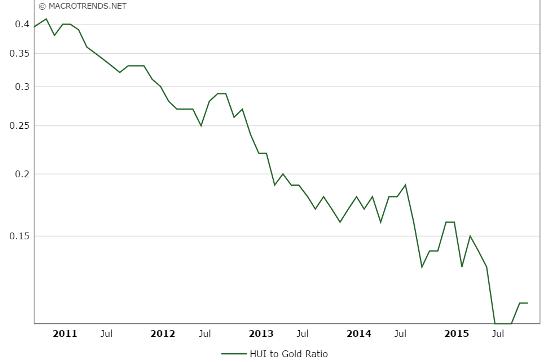

Turned out he was right. The miners just kept falling through 2014 and most of 2015, while a lengthening list of once-promising juniors died quiet deaths, taking 100% of their investors’ capital along for the ride. Here’s a chart of the HUI index of gold miners priced in gold, showing that even as gold was falling the mining stocks were declining faster.

But the bottom, says Rule, has finally arrived. In a long interview just released by Kitco, he sounds unreservedly bullish. Some excerpts:

Leave A Comment