The New Zealand dollar plunged on Thursday against the U.S dollar following the news of the final make-up coalition government.

The local currency plunged by 1.5 percent against the U.S. dollar to US70.53c on Thursday morning.

The surprise fall came after New Zealand First, the third largest political party which effectively held power, decided to form a coalition with Labour Party.

Experts had forecast that coalition with Nationals would aid growth as both the Labour and NZ First want to reduce immigration substantially and seen by most as ‘inward-looking’ compared to the Nationals.

Markets believe this would weigh negatively on economic growth going forward. Especially, with China plans to reduce credit facility of companies that import from New Zealand and the recent fall in global milk prices, a key New Zealand export.

“Combined with higher than expected milk flow from Europe in the New Year and possible unfavourable changes to the European intervention scheme, we believe this warrants some caution,” Con Williams, an economist at ANZ. writes in a note to clients on Wednesday. “Hence we downgrade our milk price forecast to 6.25-$6.50/kg MS for 2017/18.”

New Zealand inflation rate surged 0.5 percent in the third quarter and 1.9 percent year-on-year.

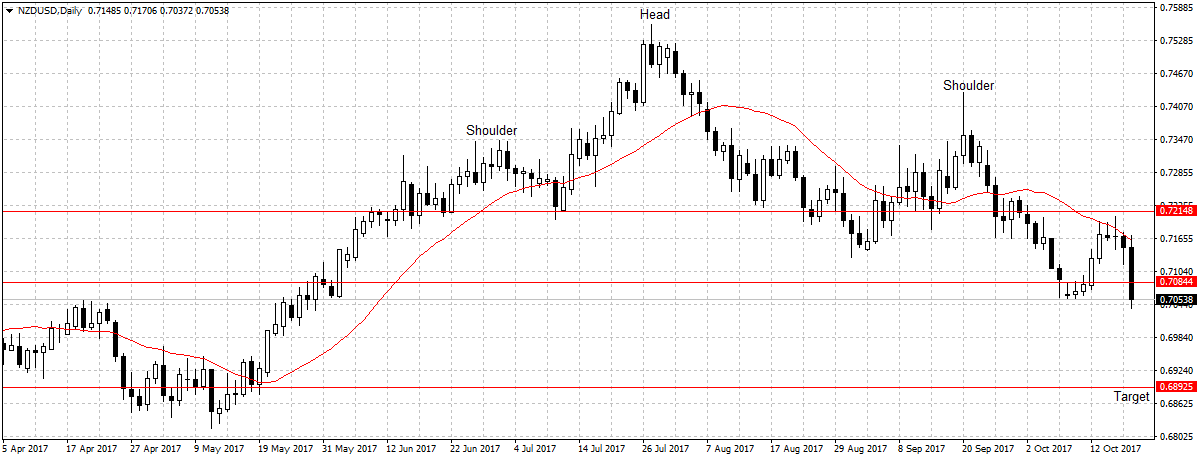

As projected in the Forex weekly Outlook Oct 16-20, the NZDUSD pair is expected to continue its July bearish move towards our target at 0.6892, until the newly formed coalition party announced it economic plan.

Also, the US open and pull back from emerging assets rush should further boost NZDUSD selloff. Therefore, we remain bearish on NZDUSD with 0.6892 as the target.

Leave A Comment