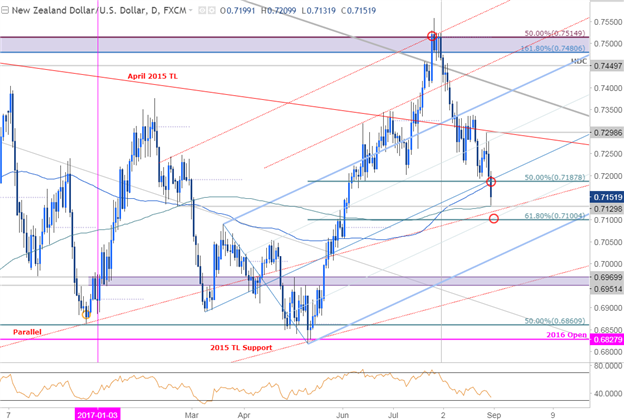

NZD/USD Daily Chart

Technical Outlook: Kiwi broke below confluence support today at 7180/88– this region is defined by the 50% retracement of the May advance & the 200-day moving average and converges on the median-line extending off the March lows. The decline is now testing interim support at the 200-day moving average / February lows at 7130 with more significant support seen at 7100.

Interim resistance now stands back at 7188. Keep in mind an objective measured move of the head and shoulders formation break eyed longer-term targets into the 6830/60key support.

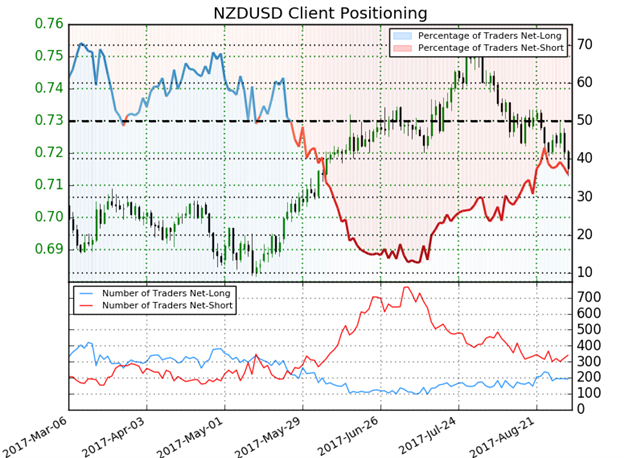

NZD/USD240min

Notes:A closer look at price action highlights a descending channel formation extending off July high with a break of the weekly opening-range lows shifting our focus lower in Kiwi. Interim resistance at 7188 with our near-term bearish invalidation level set at channel resistance, currently ~7265. A breach above this level would be needed to shift the broader focus back to the long-side.

A break below confluence support at 7100 would likely see accelerated losses for the pair with subsequent support objectives eyed at the lower parallel (around ~7015) and the 76.4% retracement at 6992. Bottom line: While the immediate risk is for a pullback off these levels, I’d be looking for a reaction near channel support with the near-term outlook weighted to the downside while within this channel.

Leave A Comment