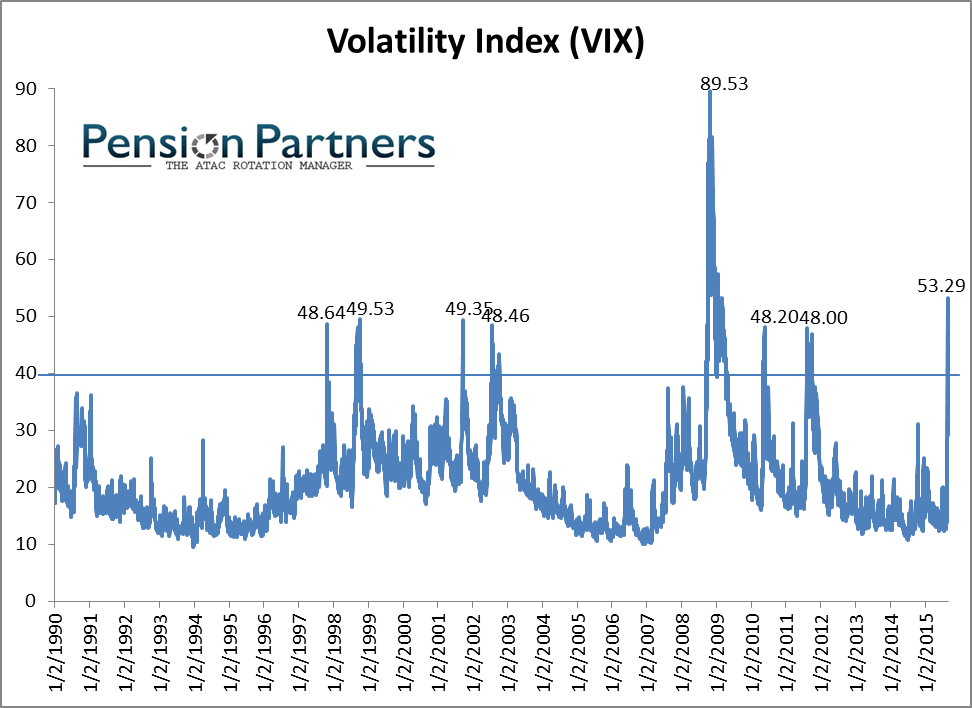

As 20 percent of the ten most damaging stock market drops in history have occurred in the past month, investors who understand the need to hedge at the same time are benefited from having proper expectations for various scenarios. While various volatility measures such as the CBOE Volatility Index® (VIX® Index) negatively correlate to the stock market 70 to 80 percent of the time, with the VIX typically rising in value at a generally consistent ratio percentage, during periods of anticipated market volatility investors might expect different results.

Such could be behind the recent odd swings in correlation ratios, volatility experts tell ValueWalk. On August 21, 2015, when the stock market lost 3.19 percent of its value on the S&P 500, the VIX index, measuring “fear” in the market, was up 8.89 points. But Tuesday, as the stock market was down near 3 percent (2.96 percent), the VIX was only up 2.38 points. The returns disparity continued Wednesday, as the stock market rose 35 points, or 1.83 percent, as measured by the S&P 500, however the VIX dropped in value by 5.31 points. These are all moves that defy typical ratio percentage correlations, but those who actively trade the VIX or are involved in volatility index construction were not overly surprised.

What does the returns ratio disparity mean for the VIX, stocks and near term volatility? As investors look to hedge a potential historic Fed interest rate hike, risk management certain funds engaged in this past July, having proper expectations a VIX hedge could be a key component of delivering proper noncorrelated performance during crisis.

Credit Suisse notes put pricing inversion in S&P 500 delivery months

According to Credit Suisse Group AG derivatives analyst Edward Tom, out with a research piece Wednesday, investors should anticipate that if the stock market falls hard in the near future the VIX may “muted” in that it night not appreciate to the same degree it did on August 21. He points to an inversion in the pricing on S&P options between the September and October delivery months and says that with this in place, VIX investors should anticipate such a “muted” price reaction. He wrote:

For Tuesday’s calculation, VIX was interpolated using the Sept 25th weekly with 24 days to expiry and the Oct 2nd weekly with 31 days to expiry. Today, however, the Sept 25th contracts will be eliminated as in input to the VIX calculation and full weighting will be place on the lower volatility Oct 2nd expiry. (editorial note: VIX experts offer the correction that it is a “good portion” of weighting, not full weighting.) If S&P term structure remains inverted, in the following trading sessions we would expect to see a muted response of VIX (i.e., an underperformance of VIX to skew) to market pullbacks as an increasing portion of the spot VIX calculation biases towards lower volatility S&P options contracts.

Leave A Comment