Keep an eye on this – in an increasingly interconnected and interdependent global market, these tech selloffs are demonstrating a propensity to spread quickly. And there’s some poetic justice in that, right? After all, tech is all about connecting the world.

That’s what we said on Tuesday morning when documenting the ongoing slide in Hong Kong shares and the rather precipitous drop in Tencent which, before the recent tech rout, was on a fantastic run that last month pushed its market value to some $523 billion.

Well on Wednesday, things got worse – and materially so.

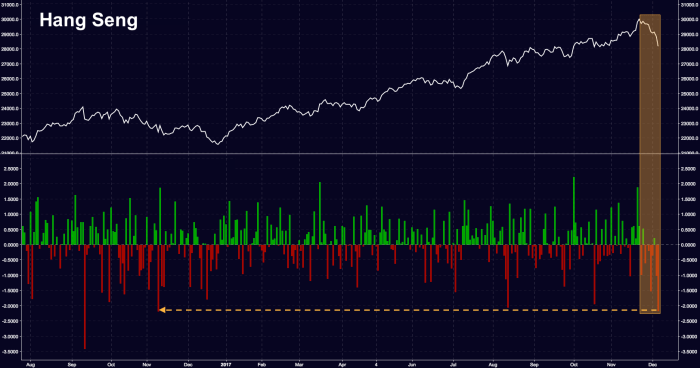

Specifically, this was the worst day for the Hang Seng in 13 months. The benchmark has now fallen in seven of the last eight sessions:

Make no mistake, this is a rather disconcerting decline for one of the world’s top-performing markets. The Hang Seng is now down more than 5% after hitting 30,000 for the first time in a decade last month. It’s now moved below its 50-DMA:

For its part, Tencent is now down some 17% from its highs, wiping out nearly $80 billion in value:

And just to drive the point home, look at a YTD chart of some of the best performers over there and note how steep the recent declines are:

That is some ugliness right there.

And Wednesday’s malaise was hardly confined to Hong Kong. Mainland shares were ultimately saved by the national team (probably) but they were sharply lower early on:

This was the worst day for the Nikkei since March:

And South Korean shares were similarly slammed. You get the idea.

All eyes will be on the Nasdaq today. Let’s see if the factor rotation continues and whether the momentum massacre gathers even more steam.

Oh, and don’t worry about the Hang Seng because according to CMB International Securities Ltd. strategist Daniel So, it’s probably going to 35,000 “around” mid-2018.

Leave A Comment