“Davidson” submits:

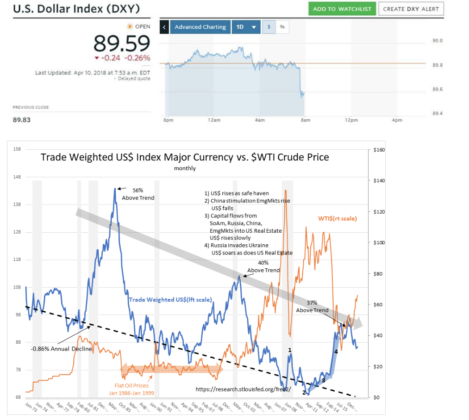

If I understand the US$/$WTI/Economic Expectations/Capital Risk-Reward relationship, Trump’s action against Syria, which is really an action against Russia, Iran, N. Korea, China efforts to attact Democratic ideals, should be reflected in a weaker US$ as capital repatriates to Emerging Markets. Algorithms have connected a belief that strong US$/ weak $WTI signals slowing economic activity. It is all connected based on past patterns even though these connections have only been roughly connected prior to 2003.

The action the past few days of weak $WTI/stronger US$ is being reversed on Trump’s strong response to Syria’s actions. Will be interesting to watch next few days.

These relationships are not lock-step but they are certainly connected to investor beliefs where the Risk/Reward is most favorable. Trump’s success in getting general tariff reduction is supportive of a stronger US$, but global trade relationships and investment opportunities still favor a weaker US$ in my sense of the overall trend of global capital allocation.

Leave A Comment