The myth of oil market rebalancing has been a great money-maker for financial markets. Hedge funds were the first to benefit in H2 last year, as Reuters has reported, when:

“OPEC and some of the most important hedge funds active in commodities reached an understanding on oil market rebalancing during informal briefings held in the second half of 2016…. OPEC effectively underwrote the fund managers’ bullish positions by providing the oil market with detail about output levels and public messaging about high levels of compliance. In return, the funds delivered an early payoff for OPEC through higher oil prices and a shift from contango to backwardation that should have helped drain excess crude stocks.”

Then the investment banks had their day in the sun, raising $19.8bn in Q1 for private equity players anxious to bet on the idea that prices had stabilized at $50/bbl for US shale oil production. This was 3 times the amount raised in Q1 last year when the price was recovering from its $27/bbl low.

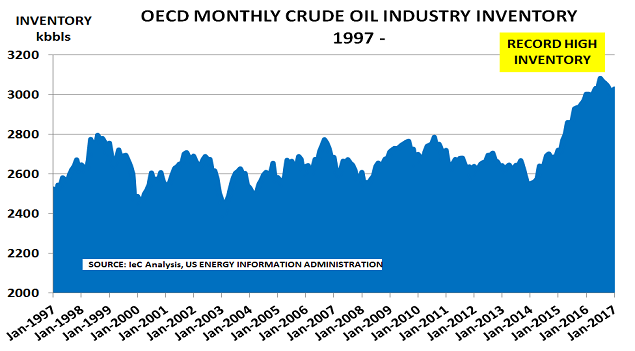

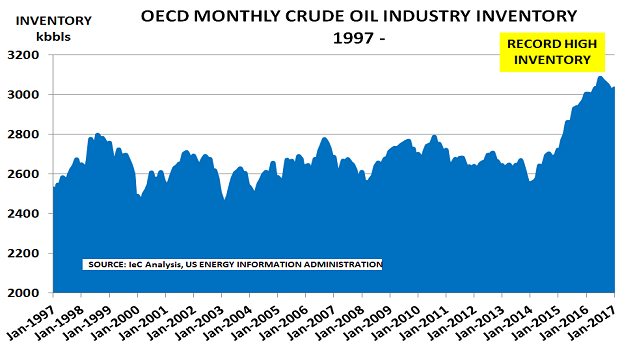

There was only one flaw in the story – the rebalancing never happened. As the chart shows, OECD inventories are now heading back to their previous record highs, having risen 38.5mb since January’s OPEC deal began. As always, most countries failed to follow through on their commitments – non-OPEC compliance was just 66% in March, and Russia is still producing 50kpd more than its quota this month.

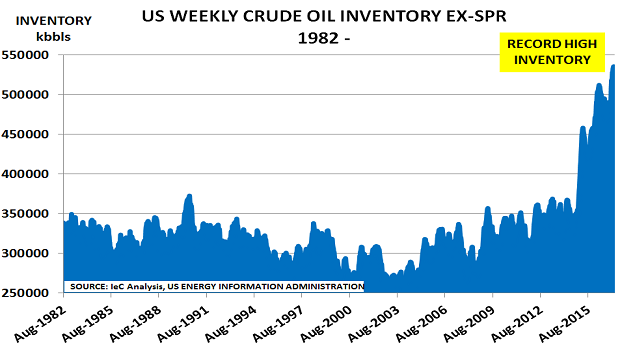

US inventories have also continued to rise, hitting all-time peaks, as the second chart confirms. Stocks would be even higher if US crude oil exports hadn’t surged by 90% versus last year to reach 706bpd this month. This is hardly surprising. Major cost-cutting over the past 3 years means that a company such as ExxonMobil now has an average cash operating cost of less than $10/bbl.

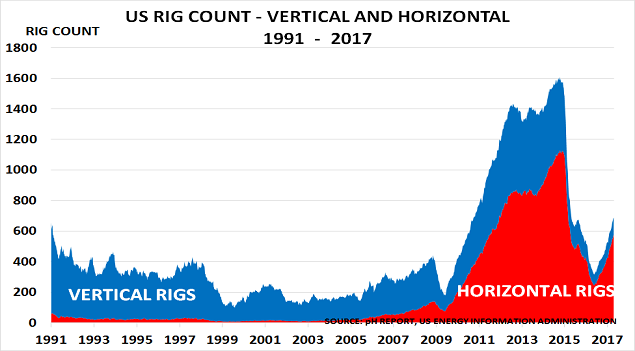

US producers have been laughing all the way to the bank, as the third chart confirms, showing the recovery in the US drilling rig count. Not only have they been able to hedge their output into 2019 at today’s artificially high prices. But they have also been able to ramp up their use of modern, highly efficient horizontal rigs. These now dominate drilling activity and are a record 84% of the total in use – reversing the ratio seen before shale arrived.

Leave A Comment