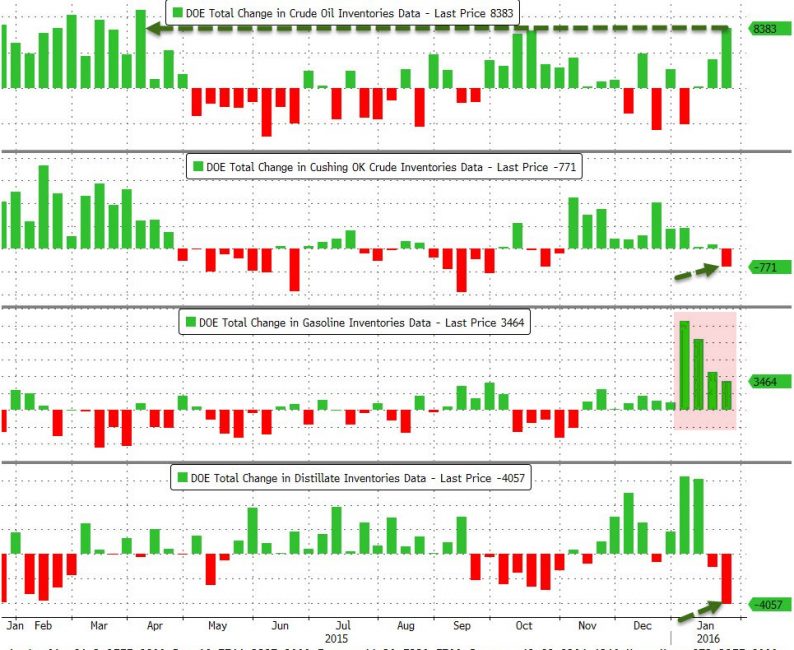

Following last night’s huge 11.4mm barrel inventory build forecast from API (the largest since 1996), DOE reports an 8.4mm build (against analysts estimates of +4mm). It seems the blowback from the huge gasoline and inventory builds is flowing back upstream to crude but there is some good news as Cushing saw a 771k draw after 11 weeks of builds (and production dropped very modestly). On the demand side, it’s just as ugly with Gasoline demand -2.5% YoY and Distillate demand down a stunning 14.8% YoY. Having tested the API ledge in prices twice this morning, WTI is hovering between $30.50 and $31.

And demand is dropping…

US DISTILLATE CONSUMPTION averaged just 3.39 million b/d over last 4 weeks, which was -588,000 b/d lower than 2015 pic.twitter.com/fLqGL7j7WN

— John Kemp (@JKempEnergy) January 27, 2016

WTI Crude’s trading machines has twice run stops back to the API ledge before this morning’s inventory data…

Charts: Bloomberg

Leave A Comment