Source: The Burning Platform

The oil-rich country of Venezuela has stopped accepting the U.S. Dollar as payment for oil.

Last week President Maduro warned that the country would this week ‘free’ itself from the US dollar.

“Venezuela is going to implement a new system of international payments and will create a basket of currencies to free us from the dollar,”

Yesterday Venezuela temporarily suspended the sale of U.S. dollars through its Dicom auction system. This (and other moves) was in response to U.S. sanctions put in place by the Trump administration.

Trump claims the sanctions are there to punish the country’s autocratic leaders. Maduro claims Washington’s move was part of an “economic war”.

This morning The Wall Street Journal reports that the Venezuela is already telling oil traders not to accept the US currency.

Oil traders who export Venezuelan crude or import oil products into the country have begun converting their invoices to euros.

The state oil company Petróleos de Venezuela SA, known as PdVSA, has told its private joint venture partners to open accounts in euros and to convert existing cash holdings into Europe’s main currency, said one project partner.

The decision to suspend dollar trading on Diacom and to no longer accept the U.S. currency for oil is potentially a major blow for the world’s reserve currency.

Venezuela’s decision comes at a time when other countries (namely Russia and China) are already finding ways to avoid using the U.S. dollar.

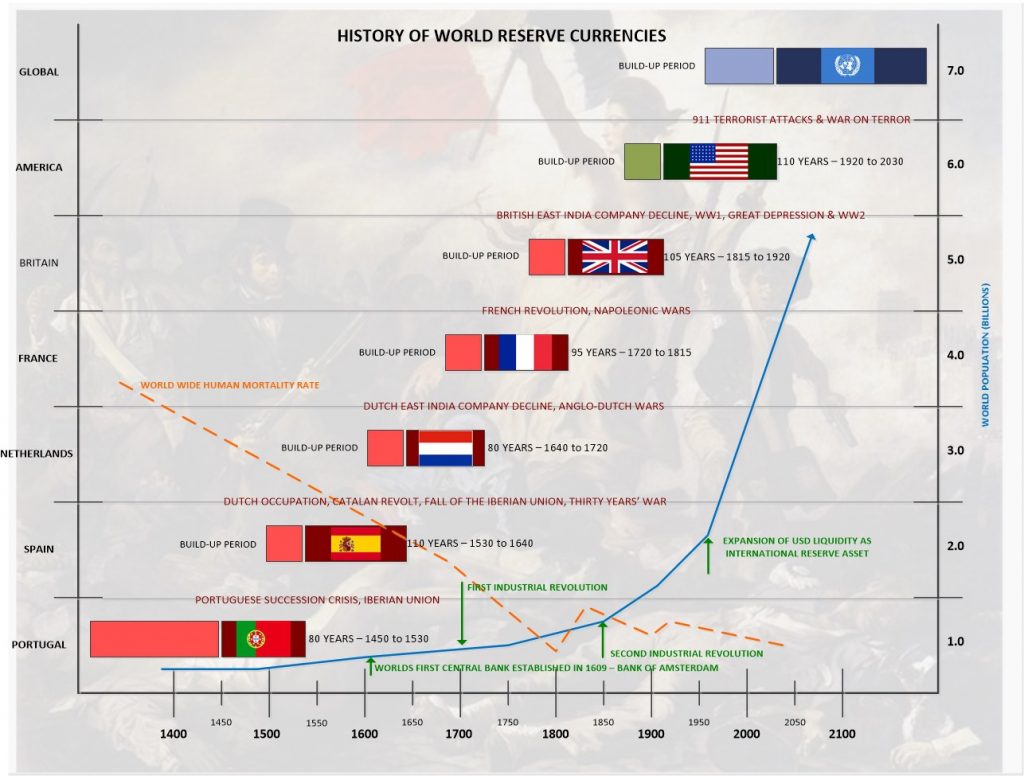

History shows us that currency domination does not last forever. Are we seeing the cracks in the latest global currency reserve system? Will those who seek to come out of the shadows and force of the US begin to build up their own systems to survive outside of the U.S. dollar and how important will gold be?

Leave A Comment