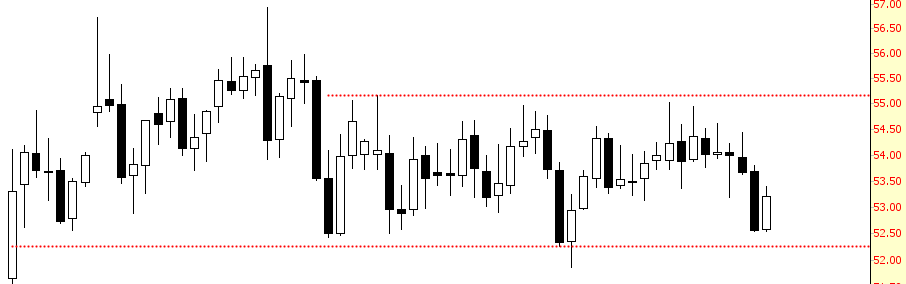

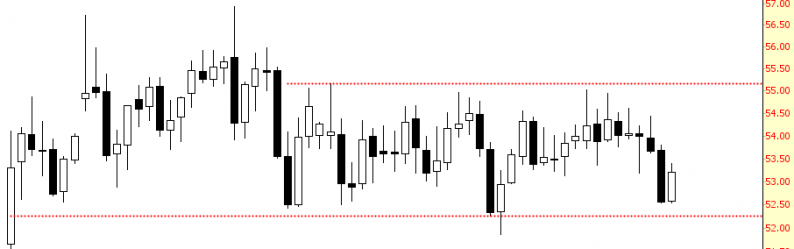

I’ve been quite obsessed with oil for months now, although it’s challenging, because black gold itself has been absolutely range-bound for no fewer than three solid months now. The good news, I think, is that the opportunity for a break is getting closer, as shown below. We must close beneath that lower red line, however. The cartel is doing a yeoman’s job of keeping the price at more-or-less $54 for countless weeks.

Beneath the surface, however, things are definitely weakening. Look at the oil and gas sector index below, and take note of its steady downturn. It doesn’t look like oil’s chart, does it? However, oil really does need to break beneath its range to get the proverbial ball rolling.

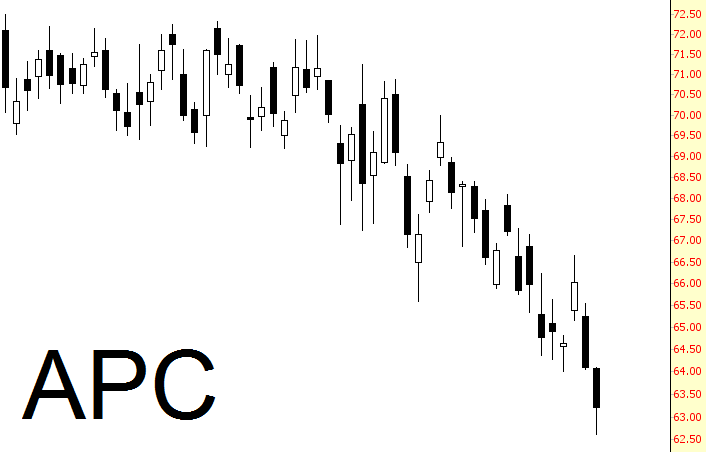

I’ve been short quite a few energy stocks, and looking at these individually, you can see the same erosion taking place, irrespective of oil’s steady strength. Take Anadarko (APC), for instance:

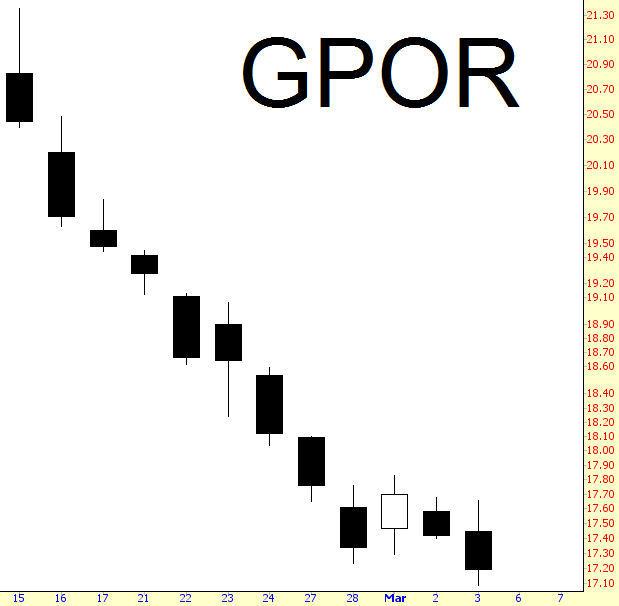

Or, more recently, Gulfport (GPOR). I’ve shown much larger charts of these same stocks before, but these closer views show how reliably they are falling.

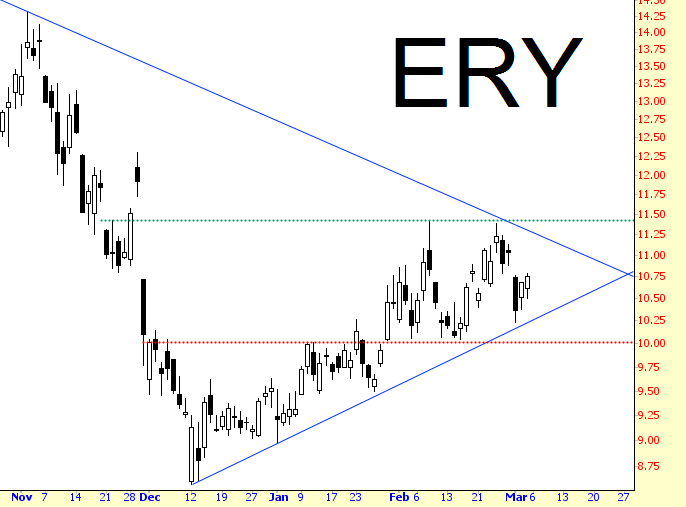

My most aggressive stance with respect to the prospect of failing energy stocks is a decently-large long position in ERY, the triple-bearish-on-energy-stocks fund. A breakout above the horizontal green line below would seal the deal.

Leave A Comment