A couple of weeks ago, we noted that according to the latest monthly report from OPEC (aside: if only drug cartels would release monthly reports), cartel crude output climbed the most since November in May.

That’s amusing because that would be the same month of May during which OPEC met to make the production cut extension official. So they were extending production cuts just as production was rising at the fastest pace since the production cuts were announced. How fun is that, right?

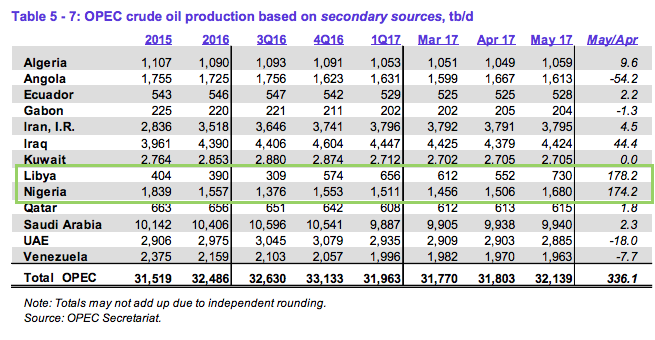

That was of course partially attributable to Libya and Nigeria, but that didn’t make it any less amusing.

Well, fast forward to this week and according to a Bloomberg survey of analysts, oil companies and ship-tracking data, OPEC production rose to a YTD high in June thanks to the same Libya and Nigerian output.

“OPEC’s crude production rose to the highest this year in June as member nations exempt from output curbs pumped more,” Bloomberg writes, adding that “members boosted their output by 260,000 barrels a day compared with May [with] half of the increase coming from Libya and Nigeria, which are exempt from making cuts.”

More specifically, the group’s production gained to 32.55m b/d in June from 32.29m b/d in May. Libya and Nigeria together added 130k b/d last month.

As a reminder, Libya is producing at a four-year high (the following chart is a bit dated, as according to sources, they’re pumping 1.005 million barrels a day):

As Bloomberg went on to report about an hour ago, citing vessel-tracking data, “observed crude exports from Libya climbed to highest in at least 3 years last month on resumption of production from Sharara oil field as well as those operated by Wintershall.”

The result: a halt in the rally that started just after crude plunged into a bear market.

“We had the survey data out on OPEC production which showed a strong increase in June, so that is putting a halt on the recent recovery we have seen in prices,” says Jens Pedersen, senior analyst at Danske Bank. “The next focal point for the market will be the rig count data on Friday, to see if there’s another drawback.”

Leave A Comment