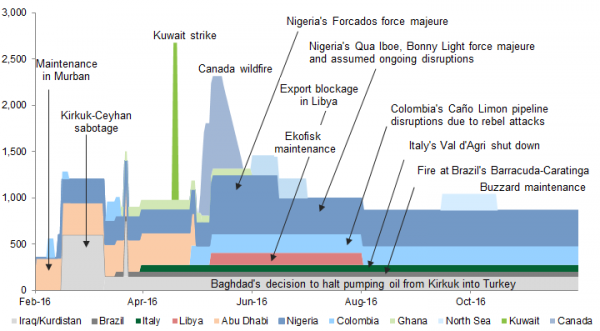

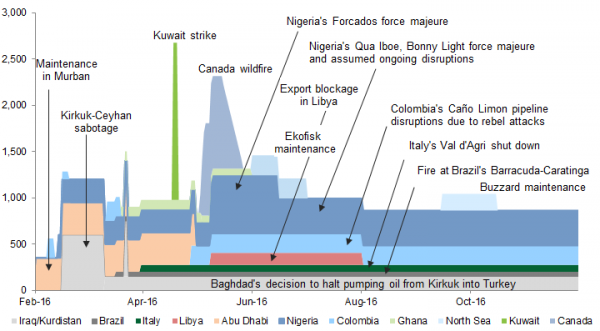

Earlier this week, Goldman unleashed the latest oil rally when it admitted that while the oil market will take far longer to rebalance due to rising low-cost oil production, it said that material supply disruptions are providing a boost to near-term prices. Goldman provided the following visualization of unplanned ongoing outages …

… where it highlighted the recent stoppages in Canada, Nigeria and Libya as the most prominent.

In a surprising twist, it appears that virtually all three of the main disruptions choke points are being resolved far quicker than expected.

First on Canada and its ongoing wildfire, the WSJ reported that the threat from forest fires in northern Alberta receded further on Thursday with the blazes moving away from oil-sands production facilities and a nearby evacuated town as cooler, wetter weather aided firefighting efforts, provincial officials said. The out-of-control wildfire spread to more than 1.25 million acres, up from just over one million acres on Wednesday, but the front line moved away from critical infrastructure to a remote area on the border of neighboring Saskatchewan province, the officials said.

Firefighters kept blazes away from two major oil-sands production complexes threatened earlier in the week, helped by lower temperatures and trace amounts of rain, said Chad Morrison, the Alberta forest ministry’s chief wildfire official.

“The threat definitely has diminished around the communities and the oil-sands facilities,” Mr. Morrison said at a news conference in Edmonton. “We held the fire yesterday in all critical areas.”

This means that oilsands production is gradually coming back online and full capacity will likely be fully restored in the coming days:

No production facilities have been damaged by wildfires, but the threat has forced several large oil sands producers to shut down mining and well sites for more than two weeks, reducing Canadian oil production by at least one million barrels a day, or about 40% of the country’s total oil-sands output. The spread of fires forced some operators to abandon plans laid last week to restart. Late Thursday, Exxon Mobil Corp.’s Canadian unit Imperial Oil Ltd. said it had partially restarted operations at its Kearl oil sands mine about 47 miles northeast of Fort McMurray.

Leave A Comment