Trading position (short-term; our opinion): Short positions (with a stop-loss order at $53.22 and initial price target at $46) are justified from the risk/reward perspective.

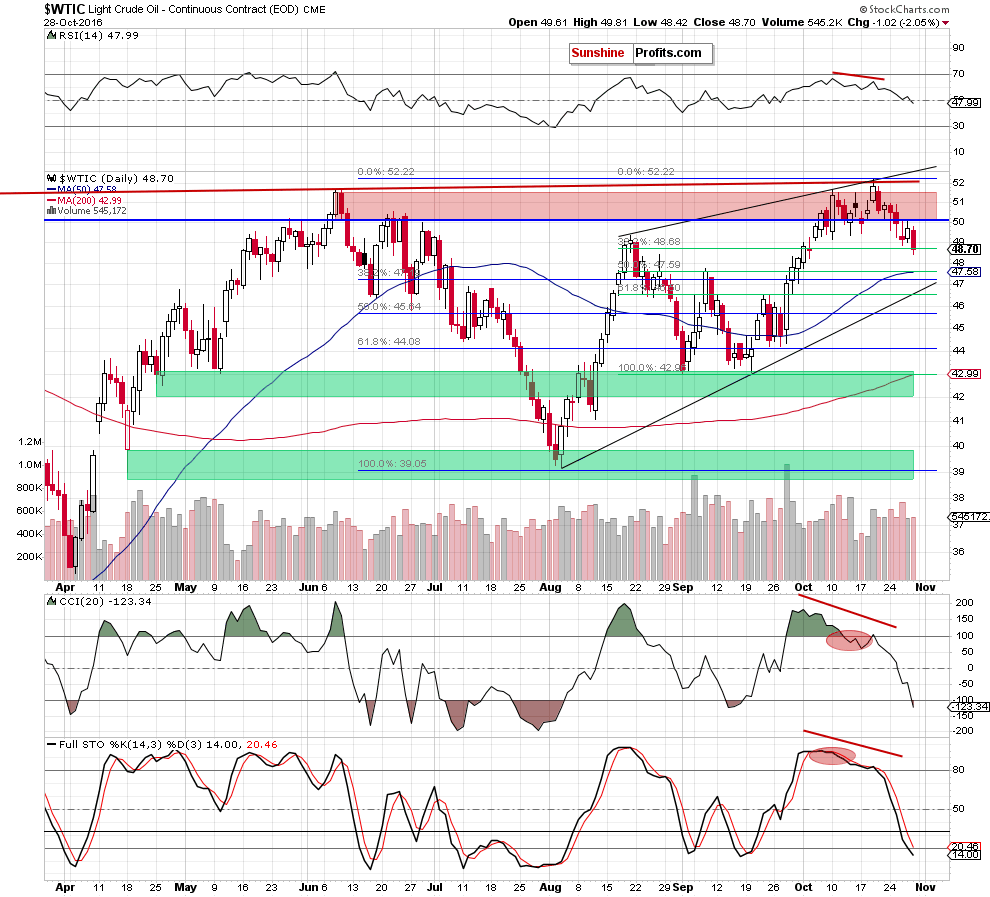

On Friday, crude oil lost 2.05% on news that OPEC officials didn’t reach an agreement in Vienna on how to reduce crude oil production. As a result, light crude slipped under $49. How low could the commodity go in the coming days?

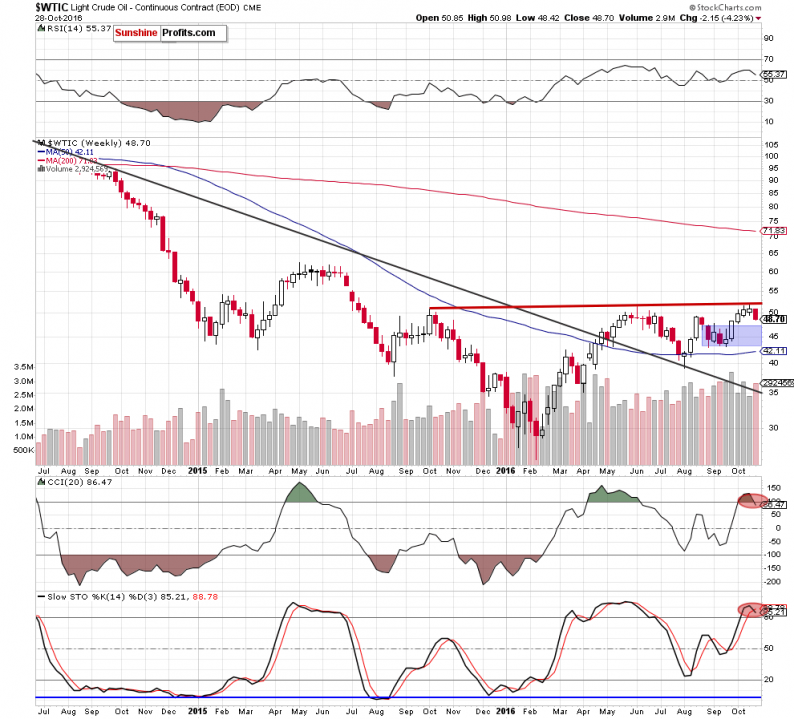

On the weekly chart, we see that the red resistance line and a sell signal generated by the Stochastic Oscillator continue to support oil bears. Additionally, the CCI finally dropped under the level of 100, generating a sell signal and supporting further deterioration.

How low could the black gold go in the coming week? We believe that the best answer to this question will be the quotes from our Thursday’s alert:

(…) crude not only tested the barrier of $50 but also slipped below it and closed the day under this important support. In this way, the commodity invalidated earlier breakout above this technically important level, which doesn’t bode well for oil bulls. Additionally, sell signals generated by the indicators continue to support further declines, which suggests that (…) if oil bears push the commodity under the recent lows, we’ll see a drop to around one of the following levels:

Summing up, short (already profitable) positions continue to be justified from the risk/reward perspective as crude oil closed the day under $49, which means that invalidation of an earlier breakout above the barrier of $50 and its negative impact on the price is still in effect. Additionally, sell signals generated by the indicators (daily and weekly) suggests further deterioration in the coming week.

Leave A Comment