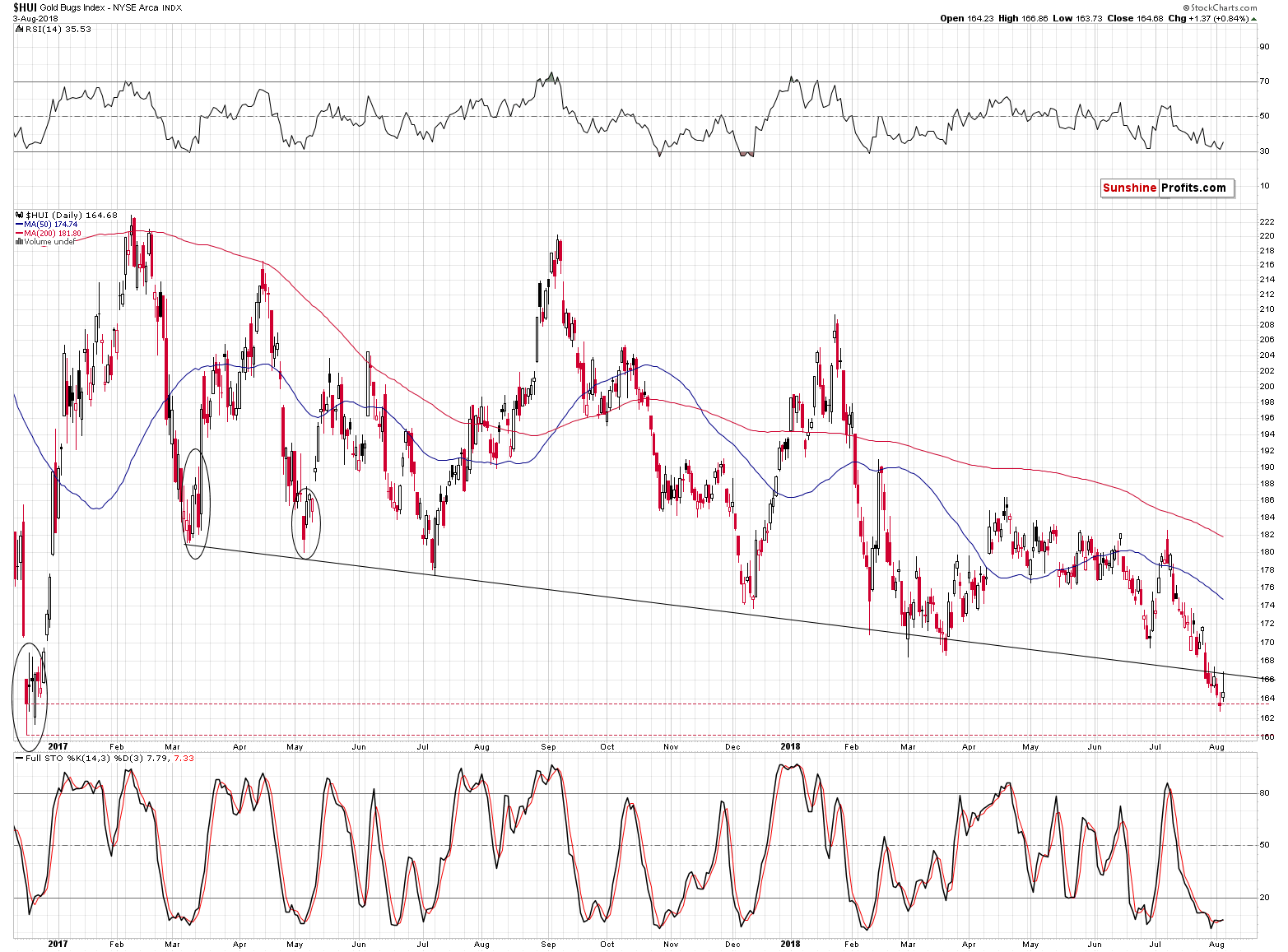

On Thursday, the HUI index just broke below the December 2016 lows (in terms of daily closing prices), but it reversed on Friday and closed the week back above this important support. Invalidations are often more important than breakdowns, so did Friday’s action just tell us that we’re going to see a major reversal?

Both: yes and no. Yes, because it was – objectively speaking – a bullish signal. No, because we might have already seen what was likely to take place. There was an intraday rally that ran out of steam and was followed by a move back down before the end of the session. We saw a new sell signal as well. Let’s take a look at the very short-term developments (charts courtesy of http://stockcharts.com).

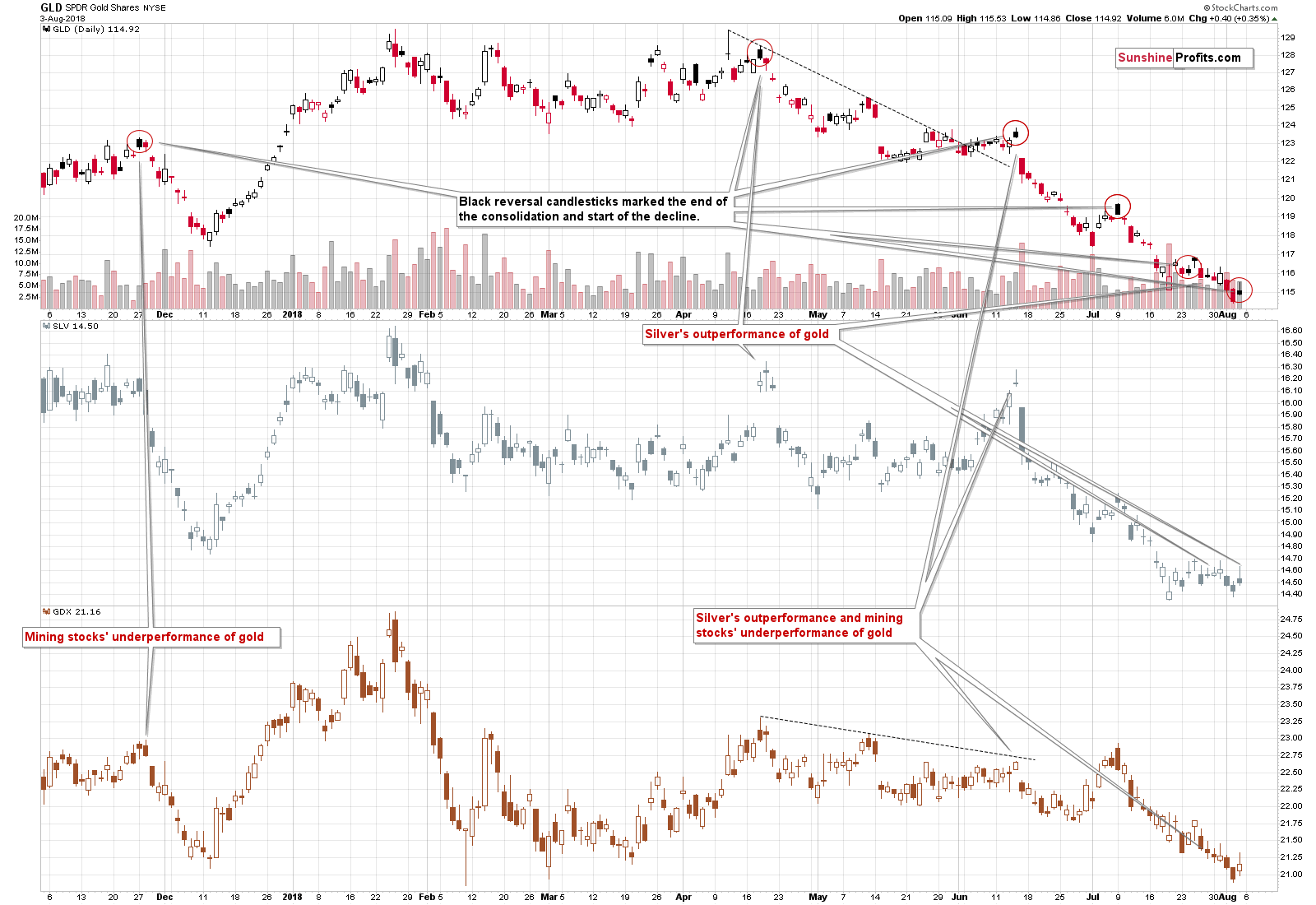

The GLD ETF ended the session only $0.40 higher and since its opening price was above the closing price, Stockcharts marked this session in black. As we emphasized yesterday, these sessions may – and recently did – indicate the end of the brief upswing and the beginning of another wave down.

The SLV price outperformed on an intraday basis by rallying almost to Tuesday’s (July 31st) intraday high, while the GLD price was not even close to its July 31st high. That’s yet another bearish sign as silver often outperforms in this way just before declines.

We haven’t seen underperformance in mining stocks, but their performance has not been particularly strong either. The GDX ETF didn’t invalidate the breakdown below the previous 2018 and lows and it bounced from the 2017 lows in a rather inconclusive manner. Overall, it seems that we haven’t seen any convincing signs from the mining stocks’ Friday price action.

With bearish signs from GLD and SLV and a neutral one from GDX, the overall implications of Friday’s intraday action, are bearish and predicting lower gold prices seems justified.

Silver and HUI’s Breakdowns and Invalidations

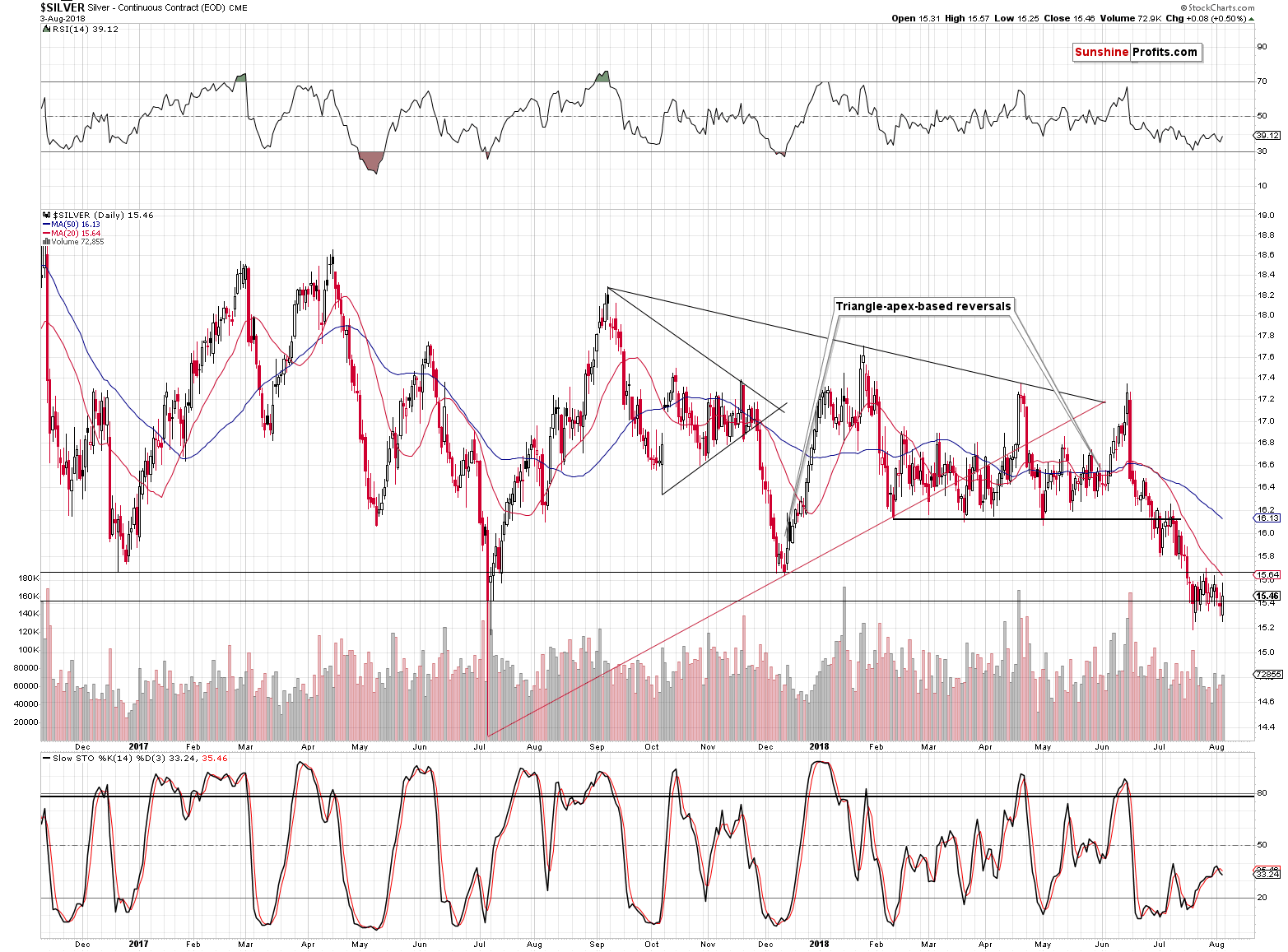

At first sight, silver and the HUI Index invalidated their breakdowns below their previous lows in terms of the daily closing prices. And that’s true. But, there’s more to the story than just that. The follow-up rallies were very small, and they resulted in some other bearish signals.

Silver closed above the July 2017 low, but it once again closed below the December 2016 and December 2017 lows, thus further confirming the breakdown and silver once again showed that the situation now is not like it was in July 2017 when silver rallied sharply higher after a volatile low was formed. If that pattern was repeating, silver should already be back above $16 – after all, the first attempt of silver to move below the July 2017 was about two weeks ago.

So, is the invalidation of silver’s break down an important bullish sign? We doubt it.

The HUI Index closed the day less than 1% above Thursday’s closing price, but it attempted to move much higher. It was stopped by the declining resistance line based on the March 2017 and July 2017 lows and thus the breakdown below this line was verified.

Leave A Comment