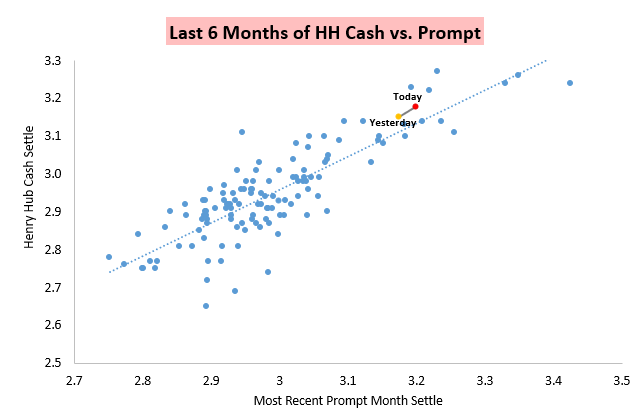

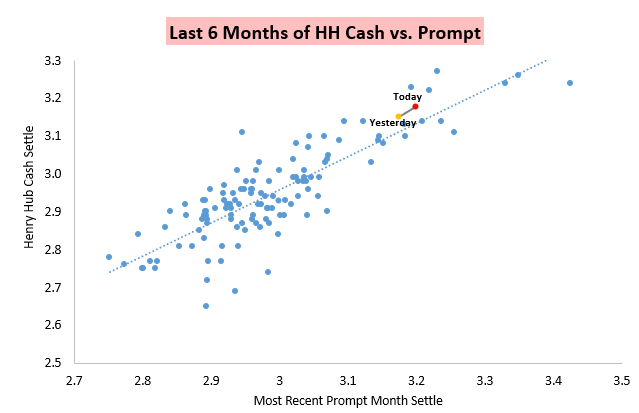

Looking at how cash and prompt month natural gas futures moved today, one would have no idea that the strongest cold shot of the season thus far is moving in tomorrow or that today was an EIA report day.

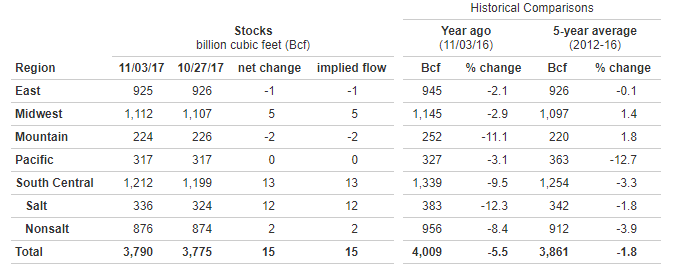

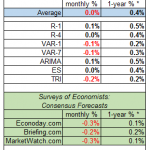

Yet here we were, watching natural gas prices recover and slowly grind higher following an EIA print that again came right in line with expectations. We were forecasting a print of +13 bcf, and the +15 bcf accordingly did not surprise.

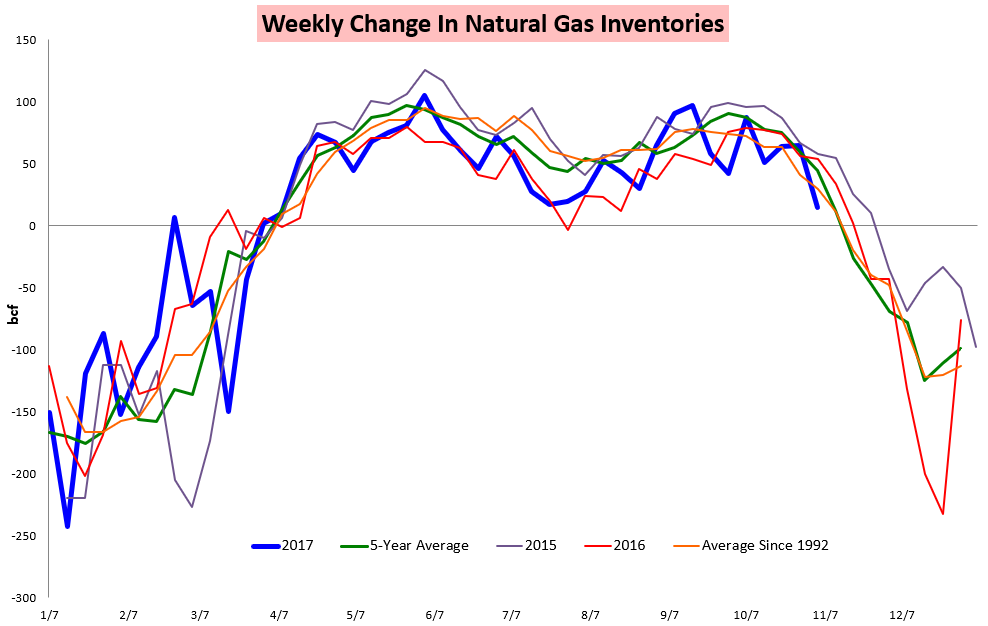

This print was significantly below the 5-year average as well as prints from similar weeks in the last two years.

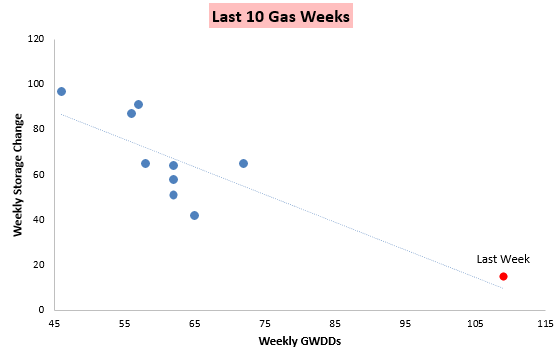

It also fell in line with prints from the last couple of months, coming in very slightly tighter week-over-week. Still, the injection was clearly being limited just by the sheer number of GWDDs we accumulated with the cold shot last week.

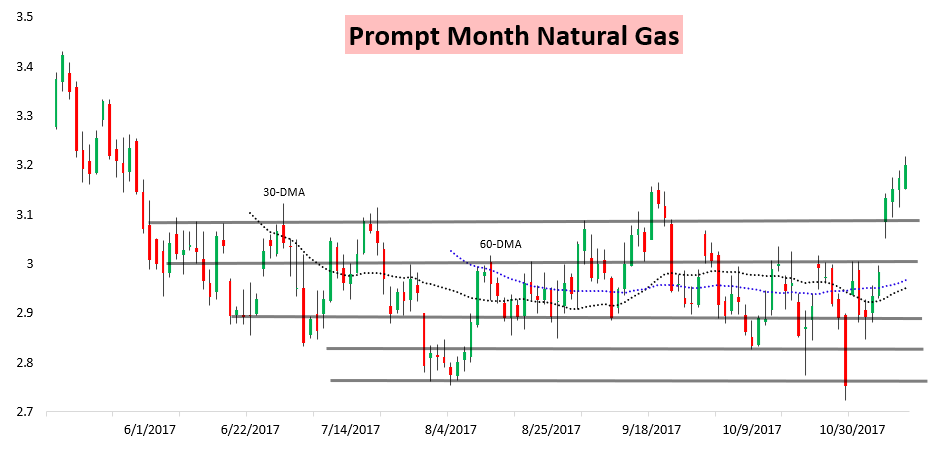

There had been rumors that the injection could even be a bit smaller than expected, and that seemed to support natural gas prices ahead of the print. Accordingly, when the fact dispelled this rumor, prices fell modestly, but recovered through the day as afternoon models continued to show cold risks lingering into the long-term. The result was yet another day where natural gas prices crept higher.

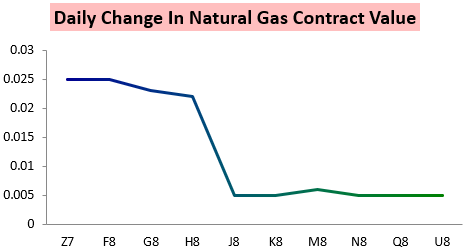

Again the gains were almost entirely weather-driven, with H/J widening further.

The conclusion from this price action is thus clear. Bulls need cold weather expectations to remain or intensify, continuing to expand H/J and push the front of the strip higher. Bears need cold to under-perform and long-range forecasts to warm; with fewer GWDDs in the 15-day forecast we would easily pull back. As we head into the weekend, then, natural gas traders will continue to have their eyes glued to weather forecasts.

Leave A Comment