Well then, Wells Fargo’s Chris Harvey is going to go ahead and make a pretty bold call ahead of the Fed, although I’m not entirely sure he meant for it to be as bold as it comes across.

Obviously, the consensus is that this hike is going to have a hawkish spin on it and at least a couple of folks (e.g. Goldman and BNP) think the median 2018 dot could shift higher. Pretty much everyone expects an upgrade to the econ forecasts in the SEP although the statement could reflect a more measured tone in light of some recent disappointments on the data front and downgrades to GDP tracking estimates following the retail sales disappointment.

The above-mentioned Chris Harvey thinks Powell is going to spin this dovish and that’s going to be bullish for stocks. Here are some excerpts from a note dated Tuesday:

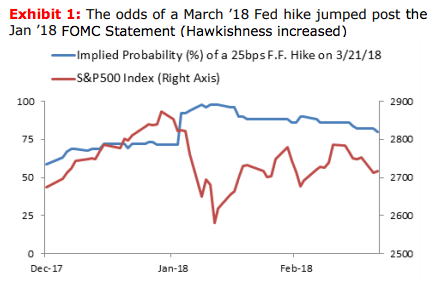

Now that the market believes the Fed will be more Hawkish, we’re leaning Dovish (Exhibit 1).

The incrementals such as Retail Sales, CPI, Atlanta Fed and credit spreads have not been Hawkish (Exhibit 2-4).

In additional, we think Powell needs to keep as much optionality as possible. He can pivot with 3 but not from 4.

What does that mean more stocks? Well, Harvey is pretty unequivocal about that, writing that “a slightly more Dovish Fed will not only place a floor under the stock market but also help walk equities higher in the coming weeks” and that, in turn, will mean “it’s back to the equity-friendly ‘low for longer’ environment.”

And he goes further than that to suggest that “in all likelihood, [this is] a plus for short volatility strategies and almost every investment style other than Value.”

So you know, “fingers crossed” I guess if you’re long.

Leave A Comment