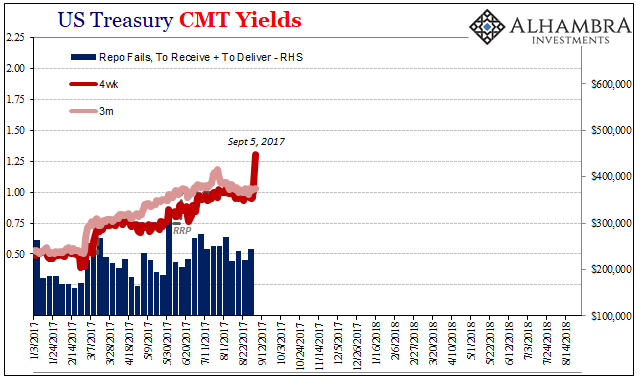

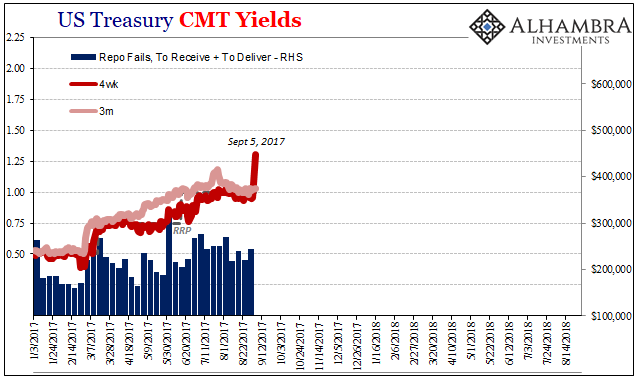

One year ago today, something broke. It wasn’t a big thing, practically a footnote seemingly not worth mainstream attention. Out of nowhere, the 4-week T-bill yield spiked. On Friday, September 1, 2017, the equivalent interest rate for the instrument was steady at 96 bps. That was already a problem because the Federal Reserve’s RRP was at the time set for 100 bps. Bill rates had been shallow all last year, suggesting that underneath conditions were already tight where it counted.

The day after 2017’s Labor Day, however, the 4-week bill absolutely plunged (price). When it was over, the equivalent yield on September 5 had surged to 130 bps. Bill rates don’t move much, so 34 bps in one day was eye popping.

No matter, “they” said. It was just debt ceiling drama. Apparently bill holders were nervous about Trump and the ongoing budget negotiations. At least that was the mainstream explanation. In my view, that wasn’t it. That couldn’t have been it. This was a liquidation of bills, and who might be in the wrong position to have had to do something like that?

I wrote a few days afterward:

Longtime readers of my columns and posts can probably guess what’s coming next. The violence in the 4-week bill was immediately dismissed as a one-off fear over a debt ceiling problem that didn’t ever seem to be much of risk or concern. It was the usual benign (in terms of repo mechanics) rationalization that is common in these times.

For an alternate (and only partial) explanation we might look instead west across the Pacific. The dominant feature of China money over the past few months has been rapid CNY appreciation.

That had been true, too. Reflation #3 wasn’t all that great anywhere else, but it was in CNY. If there was anything the slightest bit attractive about it, the Chinese currency’s miraculous rise was the one part that had inspired at least some wonder whether there might have been something to this one. This was, I speculated, the whole point. Appearances.

Leave A Comment