“A Happy Trumpiversary to all our readers this morning” – Deutsche Bank

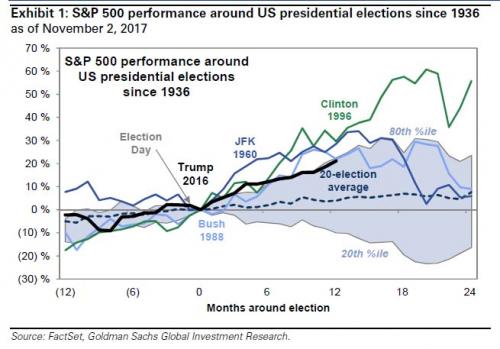

Today marks exactly 12 months since the US election on November 8th 2016, and as Deutsche Bank writes in “A Happy 12 Month Trumpiversary For Markets?” a lot has happened in the last year, although most surprising may be that for all calls of market collapse should Trump get elected, the S&P 500 has actually soared over 20% in the past 365 days according to Goldman which recently calculated that the Trump rally so far ranks as the fourth-best 12-month gain following a presidential election since 1936, trailing only Bill Clinton (1996, 32%), John F. Kennedy (1960, 29%), and George H.W. Bush (1988, 23%).

As Deutsche Bank then picks up, “needless to say that the victory was unprecedented and also a massive shock around the world. Following Trump’s victory, it was widely expected that we’d see a much higher chance of fiscal spending but also a reinforcement of the backlash against globalisation and associated forces of which migration policy and trade were probably first and foremost. In reality what we have seen in the last twelve months is plenty of evidence of backlash against globalisation, hostility and controversy, but very little in the way of fiscal policy.”

Here is the rest of Jim Reid’s observations on how the market has progressed so far under president Trump.

Leave A Comment