A cut to the headline rate of corporate tax is the cornerstone of President Trump’s tax reform policy. The US has one of the highest rates of corporation tax at 38.9% (the federal rate combined with average state and local taxes) according to the OECD, compared to an OECD average of 24.1%

[Timekess]

US lawmakers have proposed cutting the corporate tax rate to 20% from 35%, a change that is estimated to reduce federal revenues by $1.5 trillion over the next decade alone but is also expected to unlock billions in additional capital spending from companies every year.

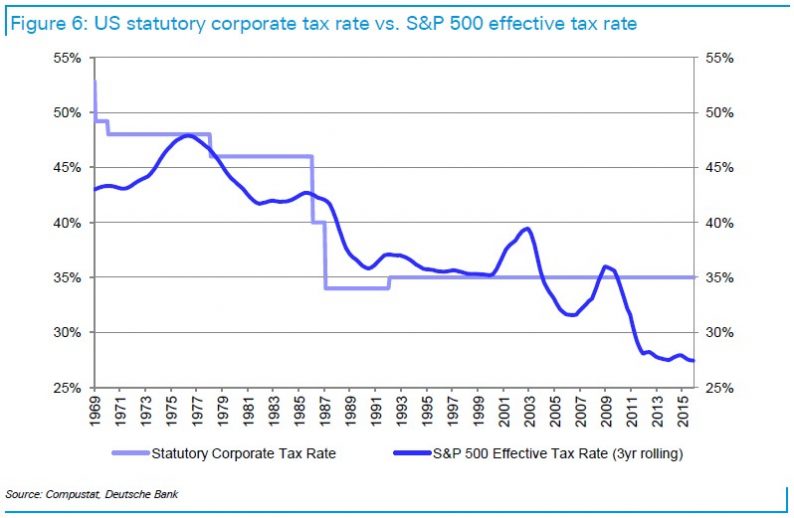

However, there’s one problem with the assumption that the average US company pays tax of just under 39% on profits: it’s wrong.

The statutory rate of 38.9% is the rate set by law and does not include deductions and credits help push down businesses’ total tax liability, meaning that many companies end up paying far less than the statutory rate — in some cases the rate becomes negative.

Indeed, including all deductions and credits, the average US corporate tax rate is 18.6%, that’s 0.1% below the average rate paid in the UK of 18.7% despite the fact that the UK has the fourth lowest statuarty tax rate in of all OECD nataions at 19%. Including deductions, Italy’s companies pay the lowest tax at -24% of profits.

Only 4% Of S&P 100 Pays US Statuary Corporate Tax Rate

In practice, few large US companies pay the statutory rate of corporation tax. WalletHub’s annual corporate tax rate report shows that the average rate paid by the S&P 100 for 2016 was 27%, the same as 2015. Two S&P 100 companies (General Electric Co. and Exxon Mobil Corp) are paying a negative overall tax rate and are therefore net tax benefit. For these two firms, the rate paid was around -5%.

In total five firms paid less than 10% including the two above. Dow Chemical Co., International Business Machines Corp., and Mondelez International Inc. all paid between 0% and 9%. IBM’s 2016 overall US tax rate was -10%.

Leave A Comment