After the big meeting OPEC had, WTI oil closed up 10 cents at $57.40, making this out to seem like an unimportant event. However, that’s not the case because this decision was already priced in. It was so important that the market calculated exactly how it would affect prices before it occurred. The decision was to cut production for nine months, but it will be reviewed in June. The market feels it is a three month cut with an option for six more months. It seems like that six month option will be realized, but that will probably be the last of the cuts. The way this is structured gives us an answer to how the cuts will be ended. Because the market will be on edge in June, ending the cuts will be supported if the six month extension is agreed upon.

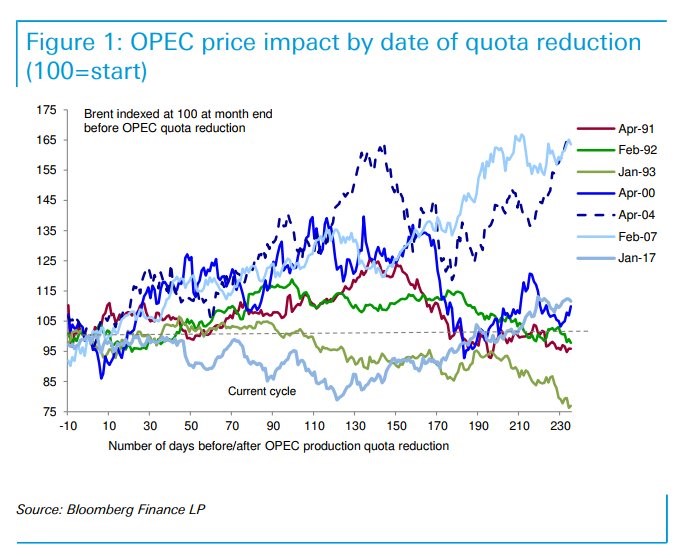

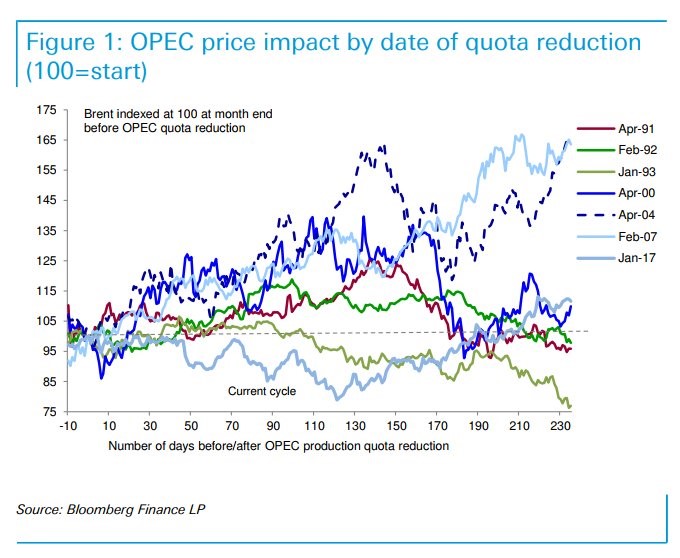

This is a great example of correctly managing the market’s expectations, getting the most bang for the buck in terms of oil price appreciation. That doesn’t solve the fracking problem, but there’s little OPEC+ Russia can do about that. The chart below shows how these quotas have affected oil prices compared to the previous production cuts. As you can see, these cuts have helped prices the third most, but it’s a big drop off from the top 2.

Dispersion Earlier In The Week

The chart below shows an interesting dispersion in sectors which occurred earlier this week. The semiconductor sector got hit hard as some say the cycle is over. Nvidia stock was down 9.47% in 3 days. Nvidia stock is up 129% in the past year so these drops are common and expected. Today the semiconductor index regained some of its losses as it was up 0.62%. On the other hand, the regional bank ETF hit an all-time high on Wednesday as it was up 6.82% when you combine Tuesday and Wednesday’s rally. Some of this is related to the tax cuts. Today, this index also reversed as it was down 0.85%. Reversals always occur when an index or stock moves sharply. However, most of both moves are still intact, making it worth talking about today.

Leave A Comment