On a day where losses were recovered and gains lost it was more of the same for indices. The index I’m watching most for leads is the Russell 2000. The Russell 2000 has languished for many months but is showing signs of strength in what could turn out to be a very good second half of the year for the index. Today saw losses which dropped the index back to rising support (a fresh buying opportunity?) but relative performance lost a little ground. Further losses would keep the index stuck inside its range and therefore be less attractive for buyers.

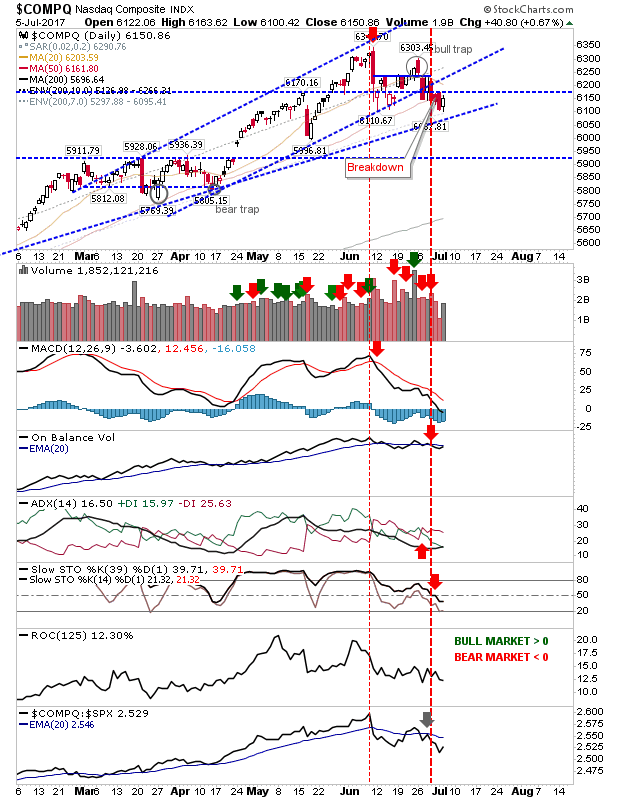

The Nasdaq recovered a little ground but the breakdown is established and will take time to reverse. Technicals are net bearish.

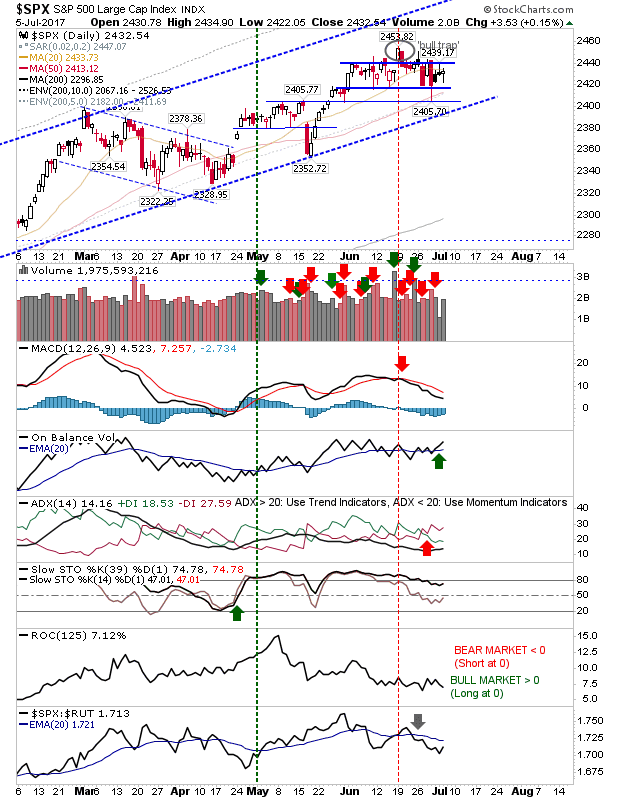

The S&P remains inside its range after its ‘bull trap’. Ordinarily, moves off ‘bull traps’ frequently reverse hard but this isn’t the case here. The 50-day MA is there to offers support should sellers take another run at this.

For the rest of the week, keep an eye on the Russell 2000. This index is key to the health of the broader market. Most indices have already enjoyed substantial rallies since Trump’s election but for these to continue fresh blood is needed – and the Russell 2000 could provide it.

Leave A Comment