Earlier this month, we highlighted comments from new Fastenal CEO (and former CFO) Dan Florness who, on the company’s Q3 call, took homage to one analyst’s suggestion that we’re currently in a “non-recessionary environment.” Here, as reminder, is the exchange:

William Blair’s Ryan Merkel: Then just lastly, Fastenal growing zero percent here in September and in a non-recessionary environment, it’s pretty surprising, I think, for a lot of us.

Florness: The industrial environment is in a recession – I don’t care what anybody says, because nobody knows that market better than we do. You know, we touch 250,000 active customers a month.

There you go. No ambiguity there. Nor was there anything ambiguous about some of the numbers Fastenal reported. For instance, in September, the company saw its first Y/Y sales decline since 2009.

And the nuts and bolts manufacturer isn’t alone.

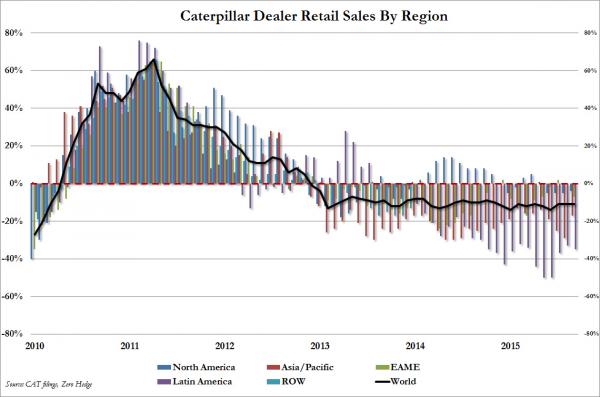

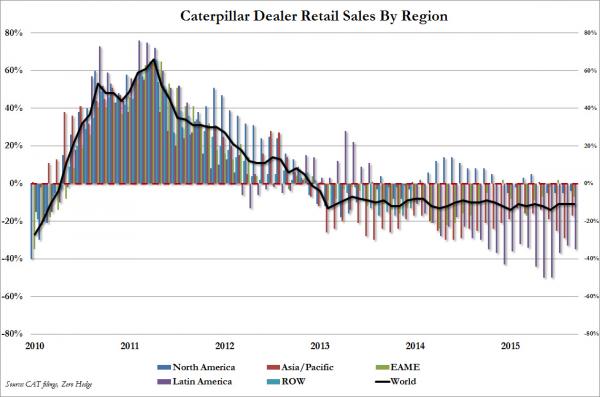

As we’ve been keen on documenting, bellwether Caterpillar (CAT) is in the midst of a truly historic sales slump that’s now entering its 35th month.

It’s fairly easy to explain this if one simply looks at what’s going on at the macro level. Everyone – the WTO, the OECD, the ADB, etc. – now seems to be of the opinion that we may have entered a new era wherein sluggish global growth and trade have become structural and endemic. China’s “hard landing” is both a symptom and a cause of the malaise and the excessively strong dollar isn’t doing US multinationals any favors either.

In this new reality, companies are gradually coming to grips with the fact that we’re simply not in Kansas anymore (so to speak) despite trillions in global QE and the proliferation of ZIRP and NIRP. As WSJ reports, “Big firms [are now set] to post [their] first decline in both earnings and sales since the recession.” Here’s more:

Leave A Comment