Well, the big week is here at last, and preparations are well underway. The podium at the Eccles building is being prepared. The microphones are being double-checked. And the poor chap who has to shave Janet’s back before each press conference is subjecting his best blade to a strop to ensure an excellent job. We’re all in this together.

When I curled up in bed Sunday night for my brief hibernation, the ES was up double digits, clearly getting a bounce from its deliciously battered state on Friday evening. “Moments ago” (as our friends ZH like to measure time) when I woke up, I was slightly bracing myself for high how the ES might have fought its way back. I say “slightly” because, as I’ve said many times recently, I intend to lighten up quite a bit before The Evil One speaks on Wednesday, and I’m already down to only 60 short positions.

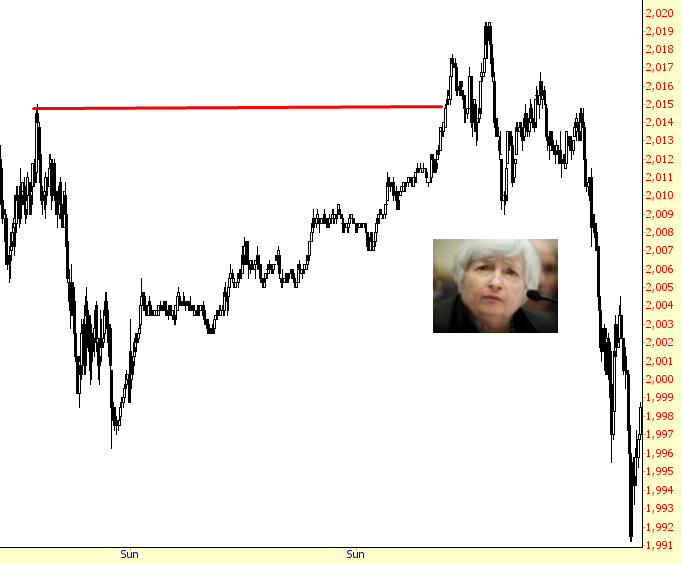

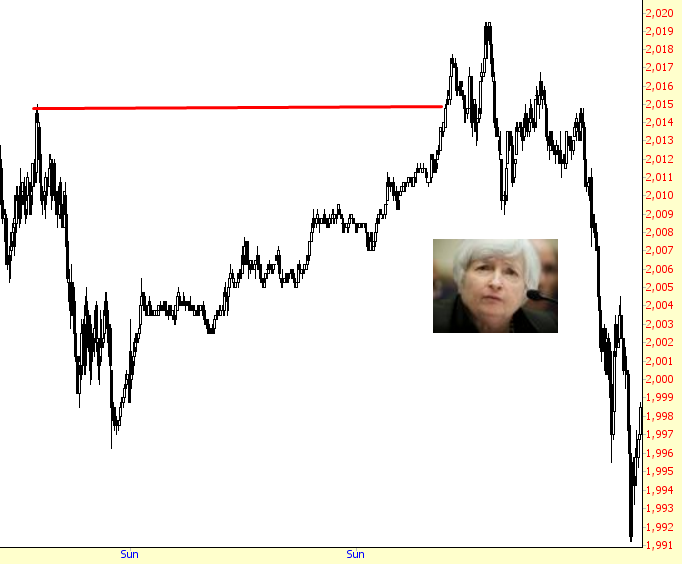

Anyway, what a surprise to see how badly the bulls have dropped the ball again:

Having scanned the news, it seems the principal reason for this fumble is the same as it has been so many times before: commodities are pooing all over the place (just to keep our metaphors consistent with the oft-used “Janet” meme) and are dragging equities down with them. Oil is at prices that haven’t been seen in over a decade.

2015 has thus been one of the most incredible, headline-grabbing, history-making years in the history of energy products. Of course, we should have known that all along, right, boys and girls? It’s not like we weren’t warned by Beauty and The Beast.

Anyway, I’m simply going to keep covering. I run the risk of missing out on a bigger drop, but that’s a chance I’ve already embraced. Good morning.

Leave A Comment