My Swing Trading Approach

My concern in the current market is the willingness of any strength being faded in afternoon trading, particularly as it pertains to morning gaps higher. The plan here, is to continue increasing stops, but unwilling to over commit to adding too many positions too quickly. Less is better, until the bulls can sustain a rally.

Indicators

Sectors to Watch Today

Incredible run in Energy over the past three weeks, with only three days in the red. It is hard to get long on a sector that is as overbought as this one. Materials bounced yesterday, following its pullback, but nothing bullish developing on the chart. Industrials holding the 20-day moving average. Still a bounce candidate. Financials have fallen for a seventh straight trading session. This sector has been pretty much untradeable of late. Avoid it for now.

My Market Sentiment

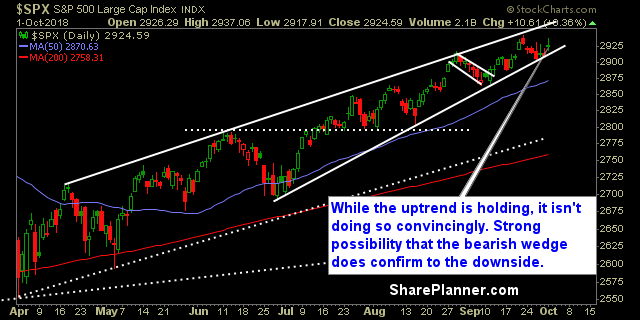

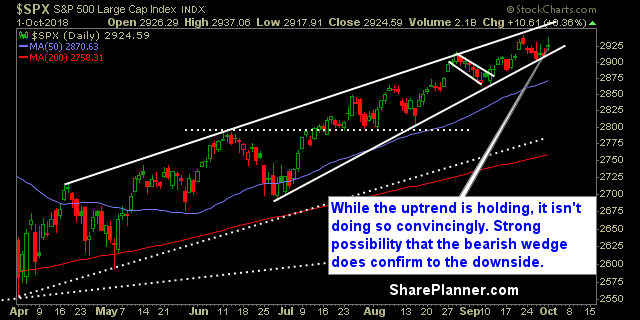

In the last seven trading sessions, there have been two green bars, and both of them have been marginal, with no real bodies to them. While price is outside of the bull flag pattern, the breakout is not convincing, and very possible we see the uptrend break here.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance

4 Long Positions

Leave A Comment