Parker-Hannifin (PH) is very exclusive company when it comes to its dividend track record. PH has paid quarterly dividends to shareholders for the past 68 years consecutively, and it has raised its dividend for 61 years running.

This amazing accomplishment puts it in the elite Dividend Kings, a group of stocks that have increased their payouts for at least 50 consecutive years. You can see the full list of all 25 Dividend Kings here.

Dividend Kings are the best of the best when it comes to rewarding shareholders with cash, and this article will discuss Parker-Hannifin’s qualities that have put it in such select company.

Business Overview

PH recently celebrated its centennial as it was founded back in 1917 by Art Parker. Mr. Parker was an entrepreneurial man in every sense of the word and he used his penchant for solving engineering problems to file over 160 patents and created the foundation for what PH has become today. The company continues to try and embody Mr. Parker’s approach to solving the world’s engineering problems and the formula has certainly worked.

PH sells a wide array of components that help power the world’s factories and machines. Part of PH’s appeal is that it is so diversified in terms of product categories and offerings. This affords it a very long and diverse customer list and thus, it isn’t reliant upon one or two industries for its revenue and earnings.

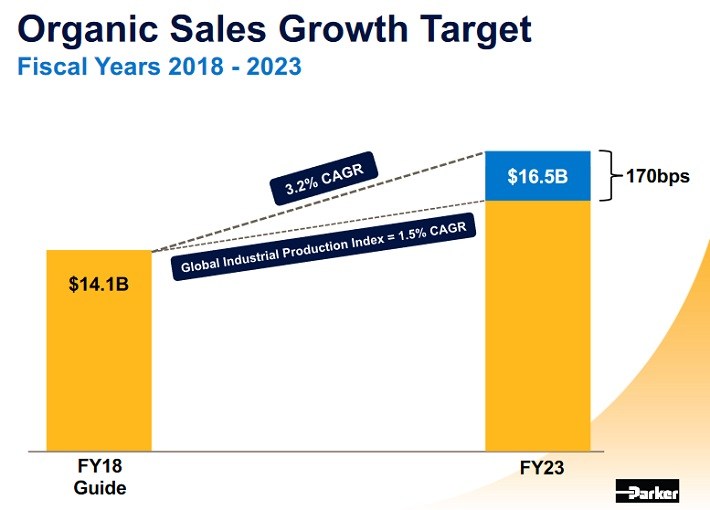

PH’s market cap is right at $24B today and the company is expected to do $14B in revenue in fiscal 2018. From there, the company expects 3%+ organic sales growth over the next five years.

Source: Investor Presentation, page 80

It operates in three major segments called Diversified Industrial North America, Diversified Industrial International, and Aerospace Systems.

The North America business is the largest segment of the three and grew larger recently with the acquisition of CLARCOR. This segment provides industrial solutions to engineering problems on a massive scale including things like valves and fittings, cylinders and actuators, hoses, piping, tubing and a host of other product categories.

The International business is nearly as large as the North America segment and provides the same sort of solutions to PH’s customers outside the US.

The Aerospace Systems business focuses on an industry where PH has decades of experience in making the world’s aircraft more efficient and safer to operate. Revenue is split roughly 47% Industrial North America, 37% Industrial International and 16% Aerospace, so diversification is strong both in terms of customers and geographies.

Growth Prospects

PH’s growth has been strong both in terms of organic expansion and acquisitions. I mentioned the CLARCOR buy and that helped push PH’s recent Q2 revenue higher by an additional 13%. PH has always been a careful acquirer, striking when the time is right but not necessarily all that often. PH has stated it wants to be an acquirer of choice and part of that is making sure it passes on acquisitions when they don’t make sense. CLARCOR made sense for PH so it made the deal and I’d expect we’ll continue to see some acquisitions going forward, even if they may come with some irregular frequency.

Leave A Comment