Biotech stocks are kind of interesting heading into the holiday shortened week. They also show why the market is so hard right now. When the market is hard, you don’t have to trade.

The group saw intraday buying Thursday and Friday. The ETFs also failed to make new lows with the market on Friday. That tells us there MAY be some risk appetite in the market.

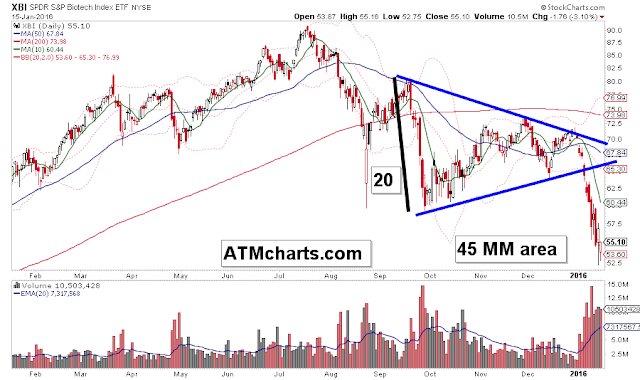

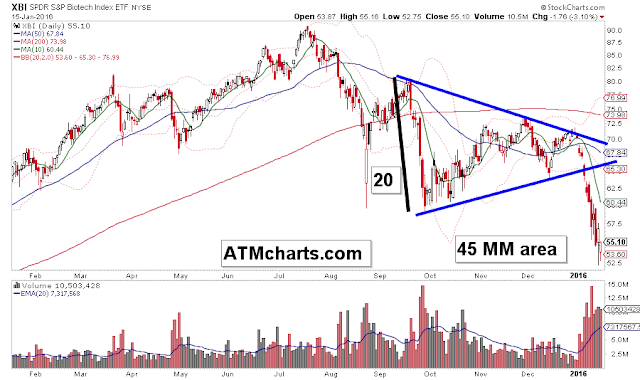

The problem here is the larger measured move suggests a move to the mid 40s. Measured moves are never sure things, but this backdrop isn’t what you want to see when looking for a sustainable market bottom.

After such a swift down move, it’s entirely possible the end of week action shows restraint by short sellers. Many biotech stocks are at support after breaking down out of larger patterns. Perhaps sellers are waiting for moving averages to catch up and provide better trend following short entries.

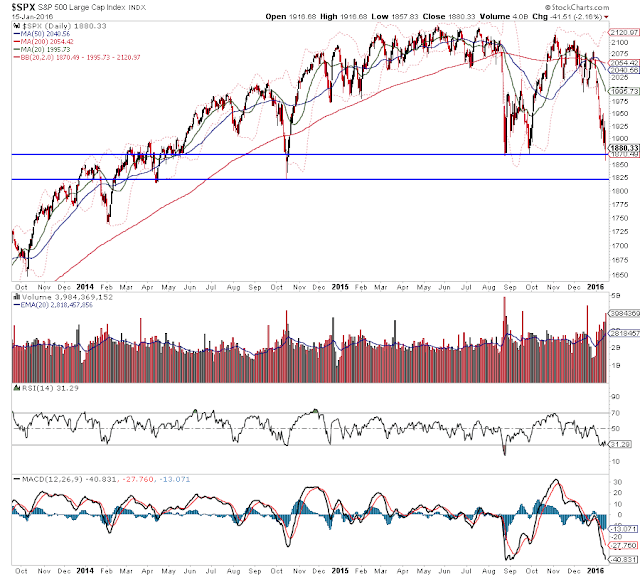

On top of that, throw in the fact the S&P 500 is at crucial yet very obvious support.

Although a near term long trade may work in some individual stocks, I would rather wait for a trade aligned with the current downtrend than force a long idea i’m not comfortable. That said, a great short trade might not show up either.

The point is, it pays to be patient and to make a habit of taking only GREAT trade ideas.

Thanks for reading. Trade ’em well!

Leave A Comment