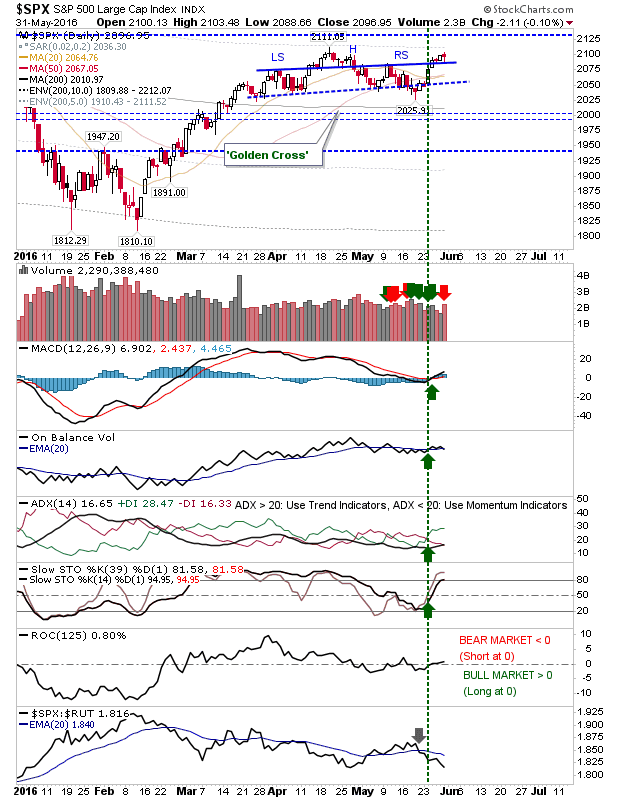

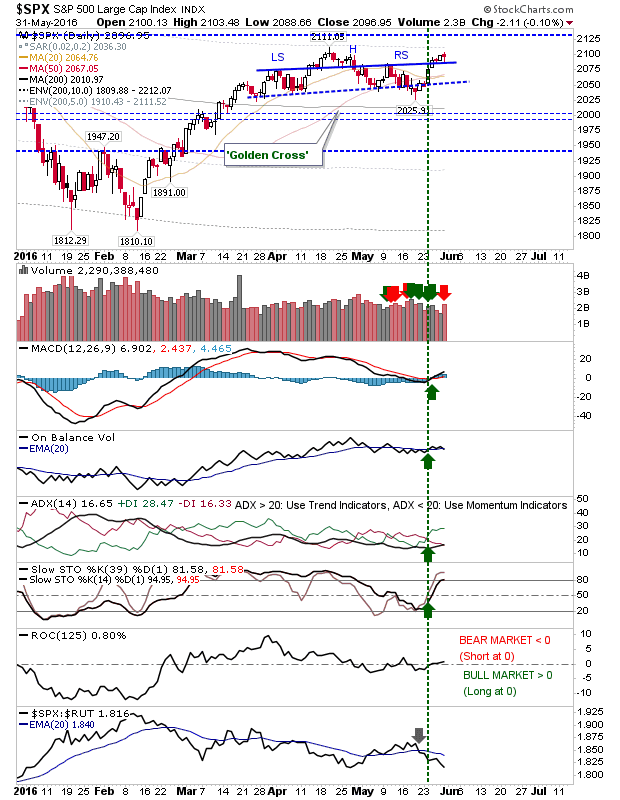

With indices knocking on the door of new highs for 2016 it was of new surprise to see some profit taking.

The S&P has struggled when it gets to 2,100, but each run at this resistance level weakens its importance as resistance. I have left the marker for the head-and-shoulder reversal, but a close above 2,111 will negate it.

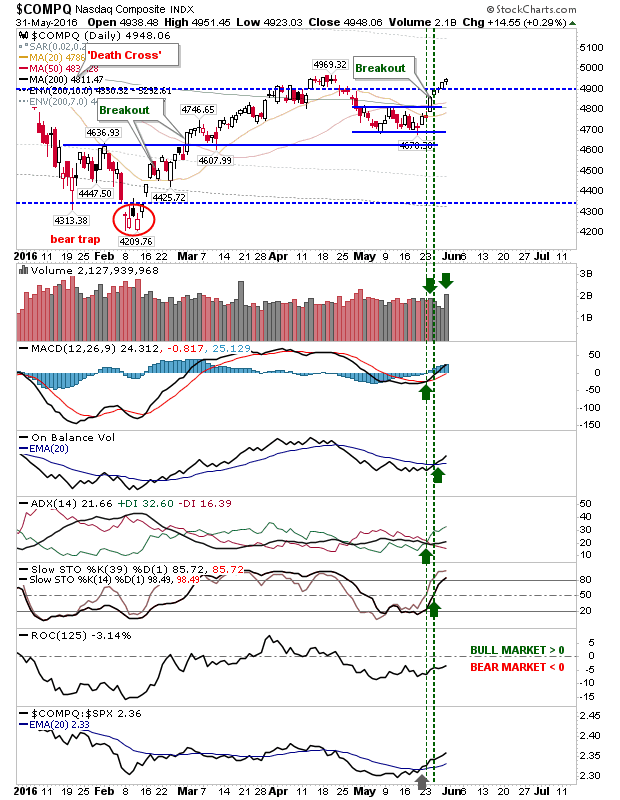

The Nasdaq was one of the indices to buck the trend by posting a gain on significant accumulation. It hasn’t yet breached 4,969, but when it does it will result in a new swing high when it happens. Technicals are net positive.

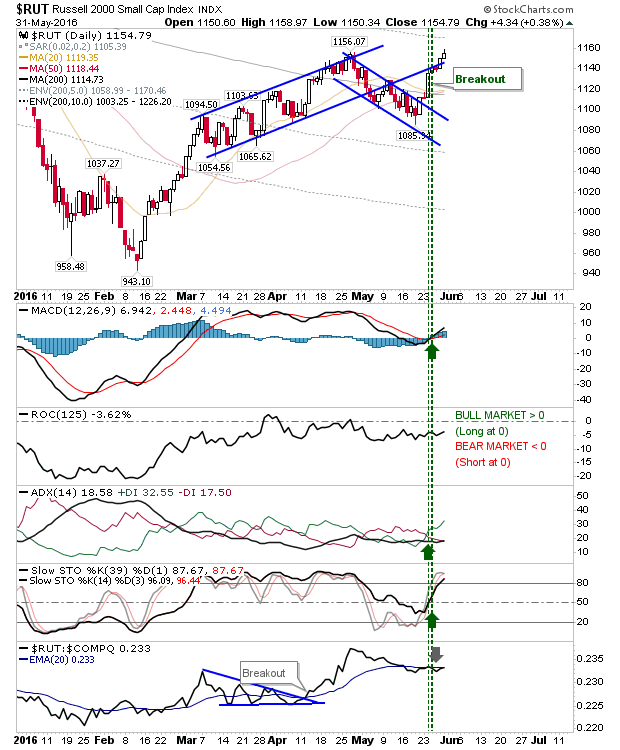

Small Caps had looked like it was going to take out the April high, but it just wasn’t able to hold out by the close of business. With technicals net positive it looks like it won’t be long before it happens. Surprisingly, despite the gain it hasn’t been able to improve its relative performance against the Nasdaq.

For tomorrow, look for further challenges on 2016 highs. Shorts could go aggressive, but the chance of a stop out are high.

Leave A Comment