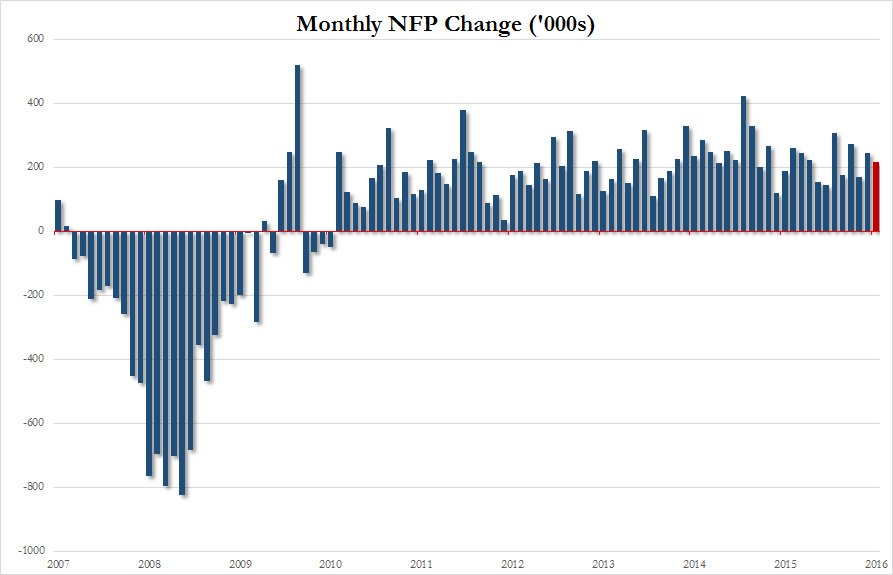

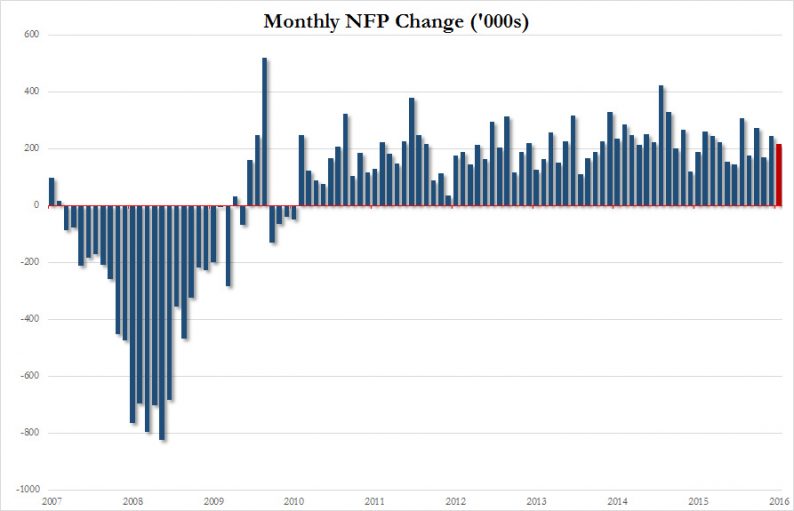

And so the confusion remains: why did Yellen go uber dove three days ahead of a day in which the BLS reported that in March not only were 215K jobs created, more than the consensus 205K, if below last month’s 245K, but in which average hourly earnings rebounded a solid 0.3%, above the 0.2% expected, and well above last month’s -0.1% decline.

Payrolls:

Wages:

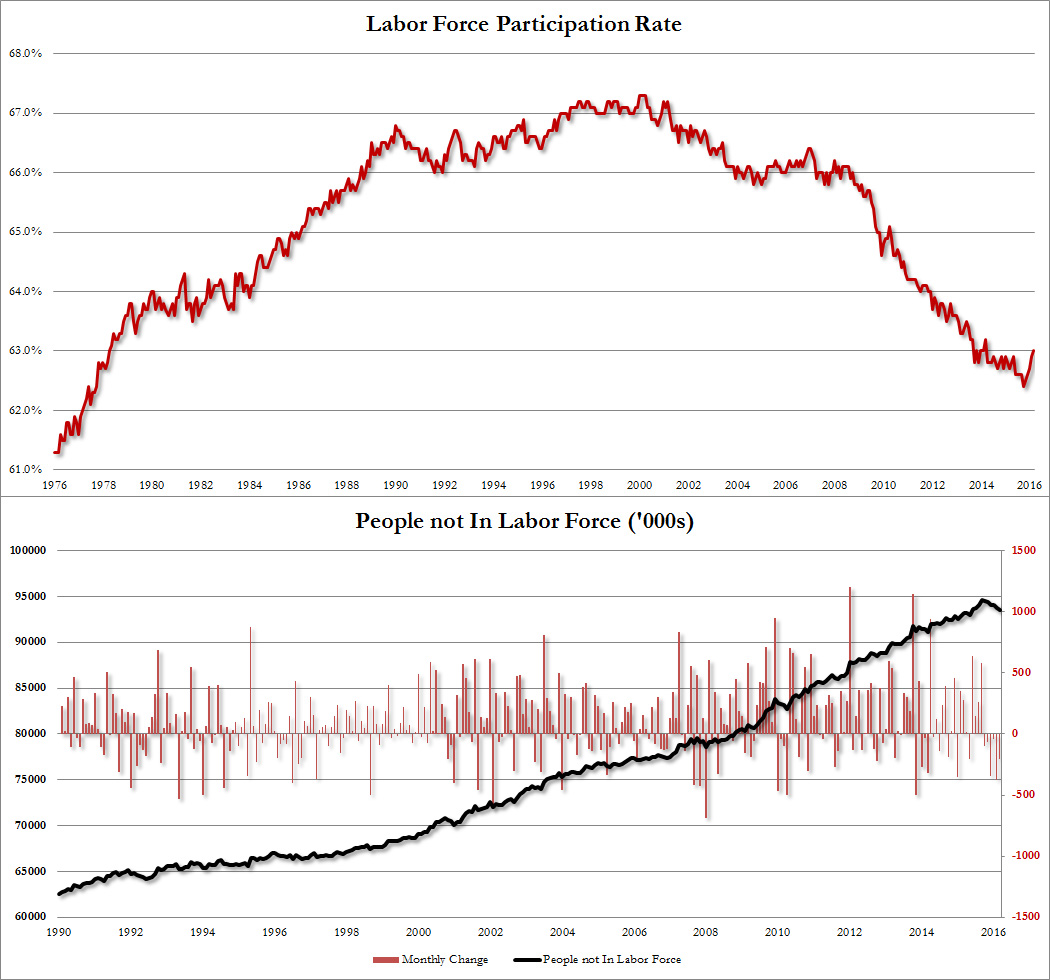

However, the fly in the the ointment was that the unemployment rate picked up modestly from 4.9% to an above expectations 5.0%. This was due to a modest increase in the participation rate to 63% from 62.9%, as 396K new civilians entered the labor force, rising to 159,286K, while 246K new jobs were added (per the Household survey) while people not in the labor force declined by 206K to 93,482K.

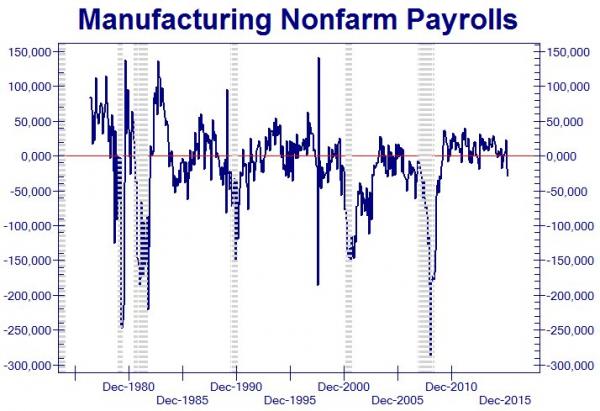

Elsewhere manufacturing payrolls dropped 29K, far below the 2K increase expected, and below last month’s -18K. Additionally, the energy recession is finally trickling down with oil and gas extraction payrolls falling 19,200 from a year earlier (chart courtesy of @not_jim_cramer).

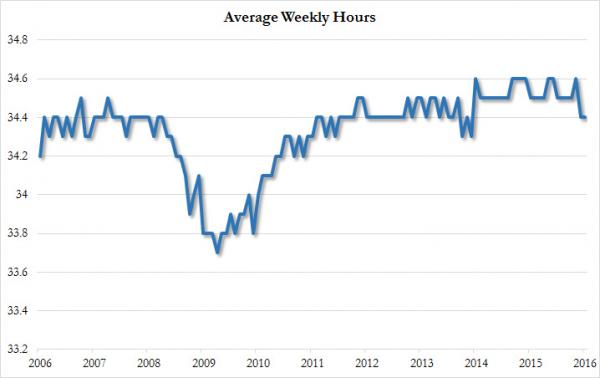

And the last notable point: average hourly hours worked remained at flat at 2 year lows of 34.6, which bodes poorfly for both productivity growth and for GDP.

On net, the report was better than expected, which means it is “good news” if only for the economy, but will it be good news for the market, which will now start discounting another Fed rate hike all over again.

Indeed, the speculation has already begun that June is once again in play as per Bill Gross, who moments ago said that “June Likely to Be When Fed Makes One of Two Rate Hikes.”

As of this moment, futures are near day lows, so Goldman’s latest forecast that “Good news is good news again” was again wrong.

From the report:

Total nonfarm payroll employment rose by 215,000 in March. Employment gainsoccurred in retail trade, construction, and health care, while job lossesoccurred in manufacturing and mining.

Leave A Comment