Following futures positions of non-commercials are as of September 18, 2018.

10-year note: Currently net short 684.7k, up 2k.

The 10-year Treasury rate (3.07 percent) has once again reached a battle zone. The last time these notes yielded just north of three percent before coming under sustained pressure was December 2013, when it retreated after hitting 3.04 percent. By July 2016, they were yielding 1.34 percent – an all-time low. In April this year, the 10-year not only surpassed three percent but also broke out of a three-decade descending channel. Yet, convincingly taking out this resistance has proven difficult. A genuine breakout has the potential to take out stops and self-fulfill. Shorts, including non-commercials, will be justified. They have done very well in the past year. A year ago, they were net short 270,120 contracts when the cash bottomed at 2.03 percent. Now, they are net short 684,712 contracts. While this aggressive buildup in net shorts worked in their favor, this very factor can act in reverse should bond bears once again get denied at the current level. TLT (iShares 20+ year Treasury bond ETF) just tested a make-or-break support just north of $116 (more on this here). Bears need a breakdown in the ETF. Else, in due course they risk a squeeze, particularly if US macro data begins to decelerate, which is increasingly looking probable in quarters ahead.

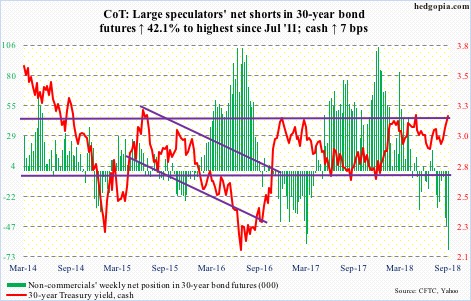

30-year bond: Currently net short 66.9k, up 19.8k.

Major economic releases next week are as follows.

The S&P Case-Shiller home price index for July comes out Tuesday. Nationally, US home prices rose 6.2 percent year-over-year in June. Prices have decelerated slightly since rising 6.5 percent in March, but they are still appreciating much faster than inflation.

Also Tuesday, FOMC meeting begins. A 25-basis-point hike is priced in. After this, the fed funds rate will be between 200 and 225 basis points. There will be a post-meeting press conference by Jerome Powell, Fed chair. Markets will be on pins and needles as to if he would care to comment on the likely path ahead, particularly next year. Currently, futures have priced in 86-percent odds of another 25-basis-point raise in the December meeting.

August’s new home sales are due out Wednesday. July was down 1.7 percent month-over-month to a seasonally adjusted annual rate of 627,000 units. Last November’s 712,000 units was the highest since October 2007.

Leave A Comment