Mexico’s state oil company, Pemex, is a perfect example of the ongoing collapse in the global oil industry. Falling oil prices and declining production are putting severe pressure on the company’s financial balance sheet. It has been four long years since Pemex posted a small profit. However, since 2012, Pemex has suffered huge annual losses while its long term debt has exploded.

The result is… Pemex is technically bankrupt. Now, I am not the only one saying this. There have been several articles written about horrible financial situation at Pemex. According to the following article, Mexico’s Largest Company Is Broke:

March 3, 2016:

Mexico’s largest company is broke. The country’s state oil company, Pemex, which is one of the federal government’s main sources of revenue, is losing money and is one of the world’s most indebted oil firms.

The company’s production has dropped for 11 straight years now, while gross income plummeted more than 80 percent last year.

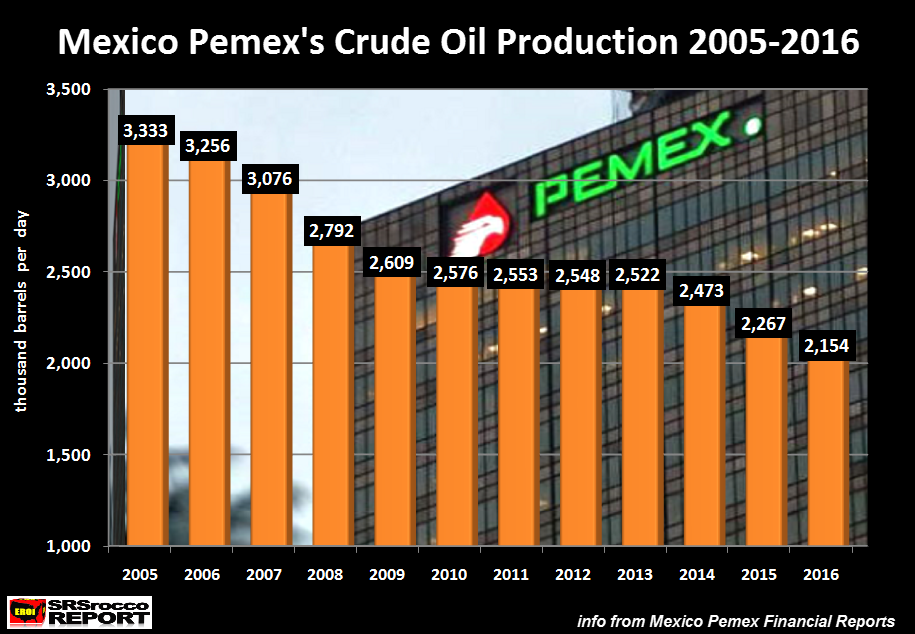

One of the biggest causes of the financial problems at Pemex is due to its falling oil production. Crude oil production at Pemex has fallen 35% since 2005, from 3.3 million barrels per day (mbd) to 2.1 mbd in 2016:

As oil prices and production declined, Pemex lost $30.3 billion in 2015 and $14.3 billion in 2016. The reason Pemex cut its losses in 2016, even as oil prices fell lower, was due to hefty budget cuts and the layoff of thousands of workers. According to the article, Pemex Will Layoff 50,000 Employees:

April 15, 2016:

Petroleos Mexicanos (Pemex) will cut up to 50 thousand workers gradually, according to Alexis Milo, chief economist at Deutsche Bank. “Pemex has approximately three times the number of employees should. Therefore, we anticipate that it will unveil a program of mass layoffs, but gradual, approximately 50 thousand workers, “explained the expert analysis.

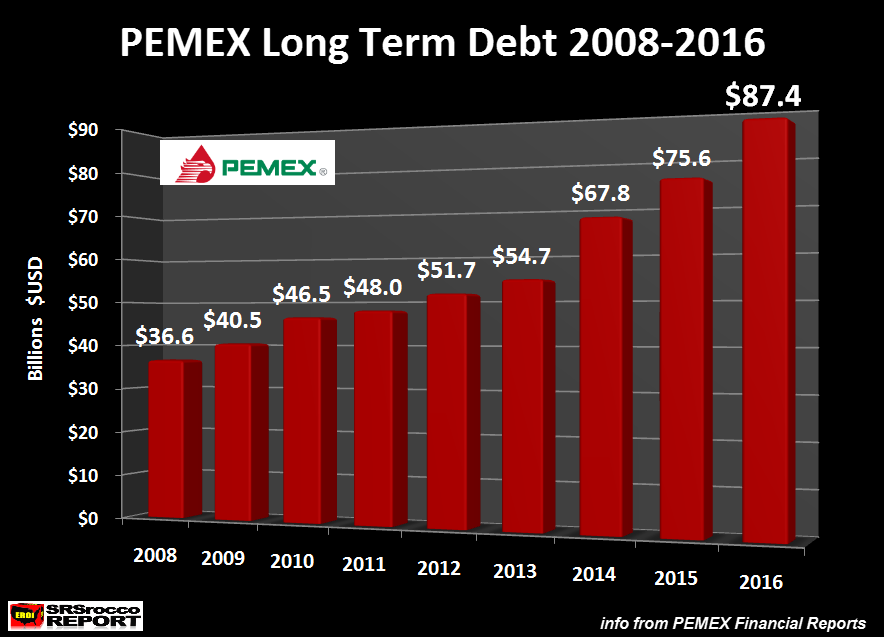

Even with budget cuts and worker layoffs, the financial situation as Pemex continues to disintegrate. Pemex’s long term debt jumped nearly $12 billion last year to $87.4 billion. Since 2005, Pemex’s long term debt has more than doubled from $36.6 billion to the $87.4 billion at the end of 2016:

Energy analysts have stated that many of Pemex’s financial problems also stem from mismanagement and possible corruption issues. While this may be true, the world’s top public oil companies have also seen their long term debt skyrocket over the past several years. For example, Royal Dutch Shell’s long term debt has ballooned from $38 billion in 2014 to $83 billion in 2016.

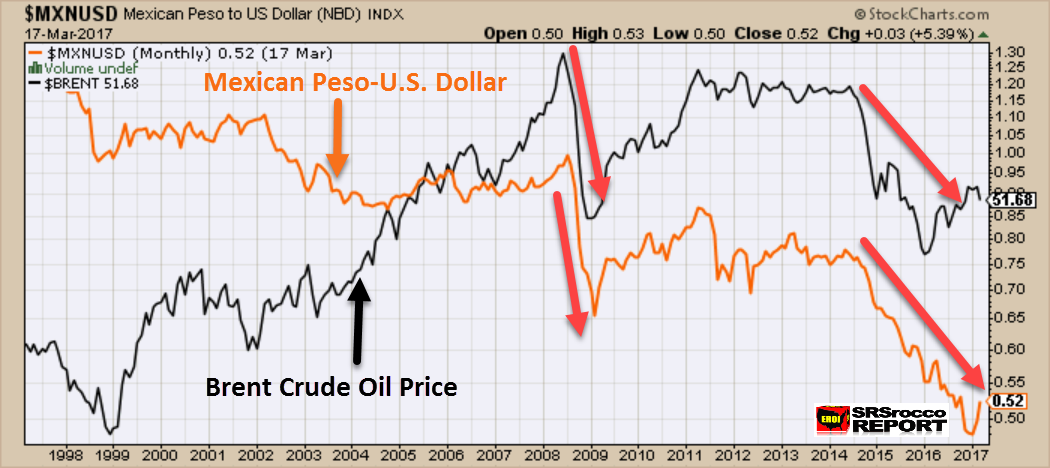

Another interesting negative side effect of lower oil prices on Mexico’s economy, is the falling value of its currency, the Peso. This chart shows value of the Mexican Peso to the U.S. Dollar over the past 20 years:

The Mexican Peso-U.S. Dollar is shown in orange, while the Brent Crude oil price is in black. As we can see the largest drop in the Mexican Peso’s value took place when the Brent Crude oil price declined significantly. Since the Brent Crude price fell below $100 in August 2014, the value of the Mexican Peso’s has fallen 32% versus the U.S. Dollar.

Leave A Comment