This morning the National Association of Realtors released the November data for their Pending Home Sales Index. Here is an excerpt from the latest press release:

Lawrence Yun, NAR chief economist, says contract signings mustered a small gain in November and were up annually for the first time since June. “The housing market is closing the year on a stronger note than earlier this summer, backed by solid job creation and an economy that has kicked into a higher gear,” he said. “However, new buyers coming into the market are finding out quickly that their options are limited and competition is robust. Realtors® say many would-be buyers from earlier this year, stifled by tight supply and higher prices, are still trying to buy a home.”

One of the biggest questions heading into 2018, according to Yun, is if the depressed levels of available supply can improve enough to slow price growth and make buying a home more affordable. While last month’s significant boost in existing sales was noteworthy, it did come with some concerns. Sales prices were up 5.8 percent – more than double wage growth – and the 3.4-month supply of homes on the market was the lowest since NAR began tracking in 1999. (more here).

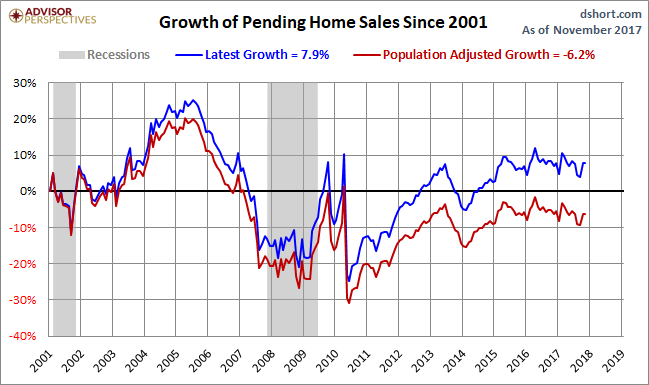

The chart below gives us a snapshot of the index since 2001. The MoM came in at 0.2%, down from the 3.5% increase last month. Investing.com had a forecast of -0.4%.

Over this time frame, the US population has grown by 15.0%. For a better look at the underlying trend, here is an overlay with the nominal index and the population-adjusted variant. The focus is pending home sales growth since 2001.

The index for the most recent month is 14% below its all-time high in 2005. The population-adjusted index is 22% off its 2005 high.

Pending versus Existing Home Sales

The NAR explains that “because a home goes under contract a month or two before it is sold, the Pending Home Sales Index generally leads Existing Home Sales by a month or two.” Here is a growth overlay of the two series. The general correlation, as expected, is close. And a close look at the numbers supports the NAR’s assessment that their pending sales series is a leading index.

Leave A Comment