“Davidson” submits:

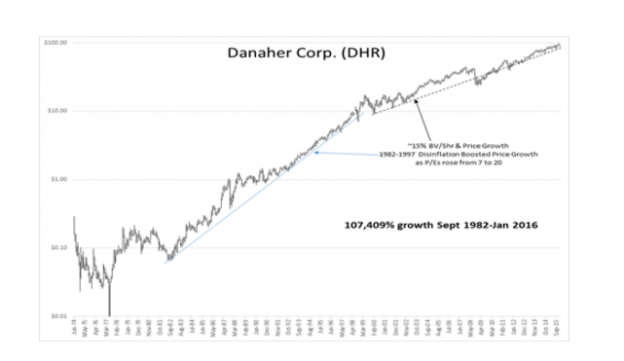

Give me a good manufacturer of ‘pumps’ or any company which does or makes something normally thought as ordinary but does it very well and one can make a lot of money. Danaher ($DHR) is a good example. Danaher tends to confuse many because it is a conglomeration of more than 1,000 companies acquired since the early 1980s. These companies operate currently under 40 separate business names. Danaher is not about what they make, but their business processes or what is called the Danaher Business System (DBS). The results are plain to see in DHR’s performance since early 1980s when Art Byrne began to develop this methodology at Danaher.

I advise investors to focus on people and their processes not the products companies produce or the concepts with which they are promoted. While many focus only on Revenue growth, Cash Flow or even the number of viewers and ‘number of clicks’, I advise investors to focus on increases in shareholder equity per share (BV/Shr growth). If Revenue growth does not translate into growth in BV/Shr, then investors should go elsewhere. The rash of ‘Environmentally Friendly’ names which many promote today are similar to the Internet names of the 1990s which crashed once the bubble was pricked. Look at DHR’s chart! DHR fell not nearly as much as the market did in 2000 or 2009 and regained investor confidence shortly afterwards as its BV/Shr growth continued. Many of today’s favorite names, while they have Revenue growth, they do not have BV/Shr growth, i.e. no/little Shareholder Equity growth. They will likely be those to disappoint the most when shareholders suddenly find fault with them. Yet, many deem them the growth stocks everyone should own. They are the media’s darlings with news every week, even news every day.

If one performs a broad study of which fundamentals drive long term market performance, the one financial measure which stands out with a high correlation to share price performance is the growth of BV/Shr or Shareholder Equity per share. This relationship cuts across all industry sectors. The one common denominator is the management process deployed to achieve these results. This process has a shortened term referred to as “Lean” by many. How this is actually achieved differs with each corporation and as individual as the corporate business culture. The result is unified and voluntary employee engagement in all aspects of corporate profitability. Producing more at higher quality with less input is what “Lean” is all about. Employee compensation and corporate profitability increase year over year. Many think of the Toyota Business System when they think of “Lean”, but “Lean” has at least as many variations as there are industries and sectors in industries.

I advise investors to learn how the better companies create Shareholder Equity per share. Most of them are not household names because they tend to be self-financing and do not need heavy Wall Street funding and promotion. These are companies which do what they do well rather than produce a unique product/service which no other company produces. It is far more difficult to highlight a management’s skill set than to hold up a product all shiny and new to explain and investment concept to investors. It is far more difficult to educate investors on the importance of management skills and how those skills can create a highly productive corporate culture regardless of whether the company makes hand tools, boiler tanks, bulldozers, offers business/medical services or investment management. Customer focus and employee engagement work long term in any industry. The end result is the same. It is all about providing ongoing value to one’s customers. “Lean” is all about driving the value to customers with continuous improvement across all aspects of business operations from manufacturing to customer service and employee engagement at all levels. Do this well and even businesses thought of as ordinary develop bottom line performances like Danaher.

I use Danaher as my example, but it is the concept of employee engagement as applied uniquely in various business cultures which is what one needs to identify to locate potentially good long term investments. Once one learns how this works, one comes to see employee engagement is a continuous process which has predicable outcomes as individual products do not.

Leave A Comment