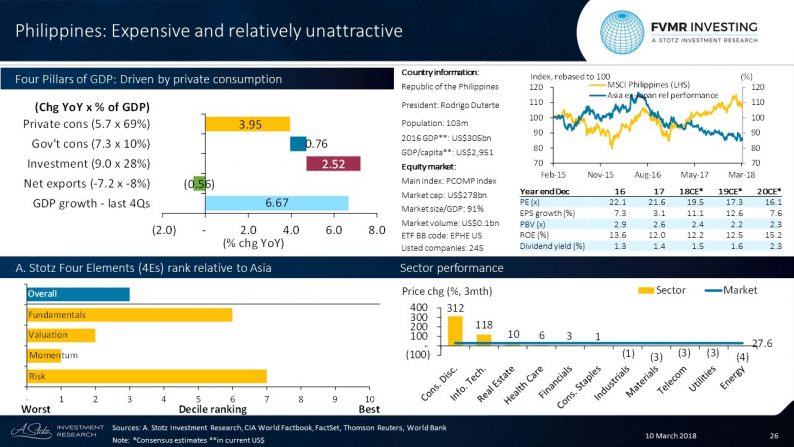

Four Pillars of GDP: Driven by private consumption

The Philippines has fast GDP growth, driven mainly by private consumption and private investments. Net export was a drag on GDP growth in the past four quarters.

The Philippines is most expensive in Asia on PE

The Philippines is most expensive in Asia on 2018CE* 19.5x PE and third most expensive on PB. Dividend yield is low and ROE is in line with Asia ex Japan.

A. Stotz Four Elements: Malaysia’s rank relative to Asia

Overall, the Philippines appears relatively unattractive in Asia considering all our four elements: Fundamentals, Valuation, Momentum, and Risk.

Fundamentals: ROE in line with Asia ex Japan.

Valuation: Highest PE in Asia, third highest PB, low dividend yield.

Momentum: Poor price momentum and relatively slow earnings growth.

Risk: Low beta to Asia ex Japan, moderate volatility.

Crazy price moves in Consumer Discretionary and Info Tech

Top 3 largest sectors: Industrials: 25% of the market; Financials: 23%; Real Estate: 12%.

Best sector & stock: Consumer Discretionary: +312.2% & Golden Haven Inc: +1,648%.

Worst sector & stock: Energy: -4.0% & Semirara Mining and Power Corporation: -11.3%.

Wait…what? Consumer Discretionary went up by 312% in three months?!

Do you believe this performance? It’s hard to believe and, in fact, we thought it was a data error. However, it turned out to be true.

The Philippine Telecom market is a duopoly with PLDT and Globe Telecom. President Duterte announced to award a third telecom license and also invited Chinese players to take a role in it as well. Golden Haven Inc, in death care, is speculated as a possible vehicle for the Villar family to become the third Telecom operator, hence, the share price was pumped up 1,648%.

And what about Info Tech going up by 118%? Same reasoning behind the speculation as mentioned above. Investors started to push up the prices in three Info Tech stocks, namely NOW, EasyCall, and Transpacific Broadband.

Leave A Comment