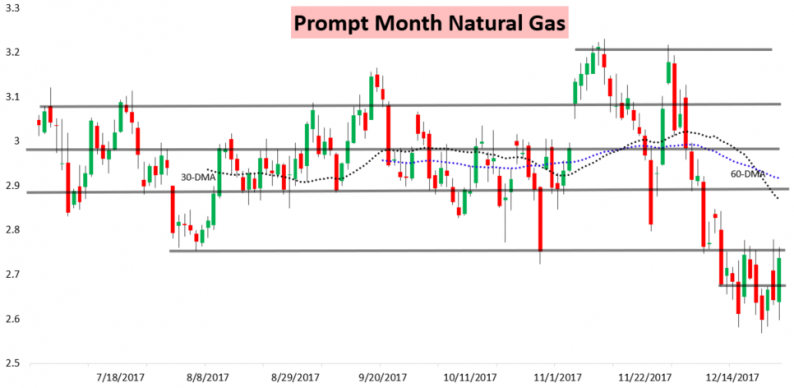

In today’s blog, we want to again break down an active day in the natural gas market but also take a look at how we used spreads to generate a profitable trade idea for subscribers. First, we note that the January natural gas strip went off the board today with a sizable rally, running right back into $2.75 resistance.

This came off colder weather trends in the medium-range as prices traded right in our expected range; last evening they bounced just above our support level, and today pulled back from the resistance level we targeted in our Early Morning Text Message Update.

This was followed by our Morning Update around 8 AM which highlighted again that a test of $2.75 was likely (we show a small excerpt below).

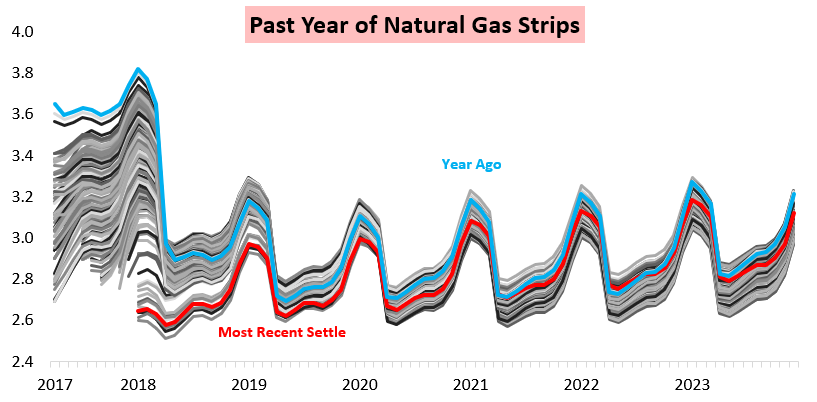

Prices were led higher today by the front of the strip, but the entire strip participated.

This comes as the front of the natural gas strip continues to sit near its year-to-date lows, which we outlined for clients today in our Seasonal Trader Report, where we forecast weather-driven natural gas demand via GWDDs for the next 5 months and break down the expected impacts of these seasonal weather shifts along the natural gas strip.

Yet today much of our focus was on the January contract into expiry, as we had been following the January/February F8/G8 spread closely. That spread rallied into the settle, as significant short-term cold has continued to spike natural gas demand.

When the weather is not as clearly driving flat price action on a day-to-day basis, we often like to generate ideas for spread plays based on the weather, when it can become possible to more easily isolate the direct impact of shifting weather forecasts. Back on December 15th, we saw F/G trading at an attractive level due to both significant cold to end 2017 and a historical trend for F to rally into expiry.

Sure enough, F/G saw that bump into expiry today, as cold into early January continues to look very intense.

Leave A Comment