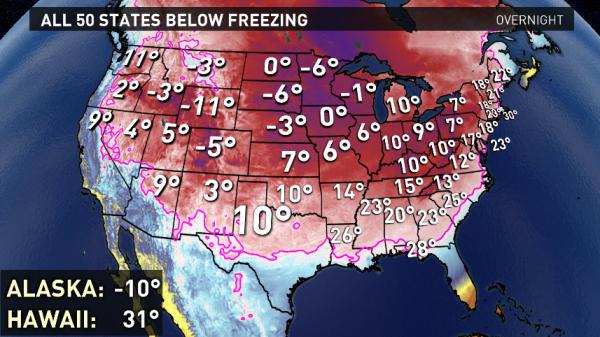

3 months ago we warned US economic growth faced a challenge more powerful than any Fed-sponsored miracle could handle and 3 weeks ago Yellen’s worst nightmare began to loom on the chilly horizon. But tonight, from the depths of the night, the cruel monetary-policy-nullifying devil of Polar Vortex 2.0 arrives as all 50 states (yes even Hawaii) will see temperatures drop below freezing…

h/t @Grant_Gilmore

On the bright side, companies will have more than just strong dollar and weak foreign growth to blame for earnings weakness… weather is back baby!!

h/t @Met_mdClark

* * *

Just one thing for those celebrating the drop in gas prices at the pump as some tax cut for the consumer (which it is not – it merely allocates the same aggregate spending dollars from gas to a different consumable – leaving aggregate spending just the same – or less in fact should consumers, as in Japan’s balance sheet recession, choose to minimize debt as opposed to maximize profits or living standards with their extra cash)… this is what happened to home electricity bills last year… (now is that a tax hike for the consumer?)

* * *

Now, the only question is how the resultant tumble in Q4 GDP will be used by the Fed and econo-pundit talking heads to justify a further delay in rate hikes, which consensus expects to take place in Q2 2015 at the latest as a result of recent seasonally massaged “strong data”, or better yet, force the Fed to resume liquidity injections once it is revealed that the ECB’s intervention is limited to verbal jawboning, while Japan’s runaway import cost inflation and plunging real wages lead to a revulsion against Abenomics and Abe in 2015, and a premature end to Japan’s epic hyper-reflation experiment and the best laid plans of Goldman Sachs to boost “risk assets” and Goldman year end bonuses.

Leave A Comment