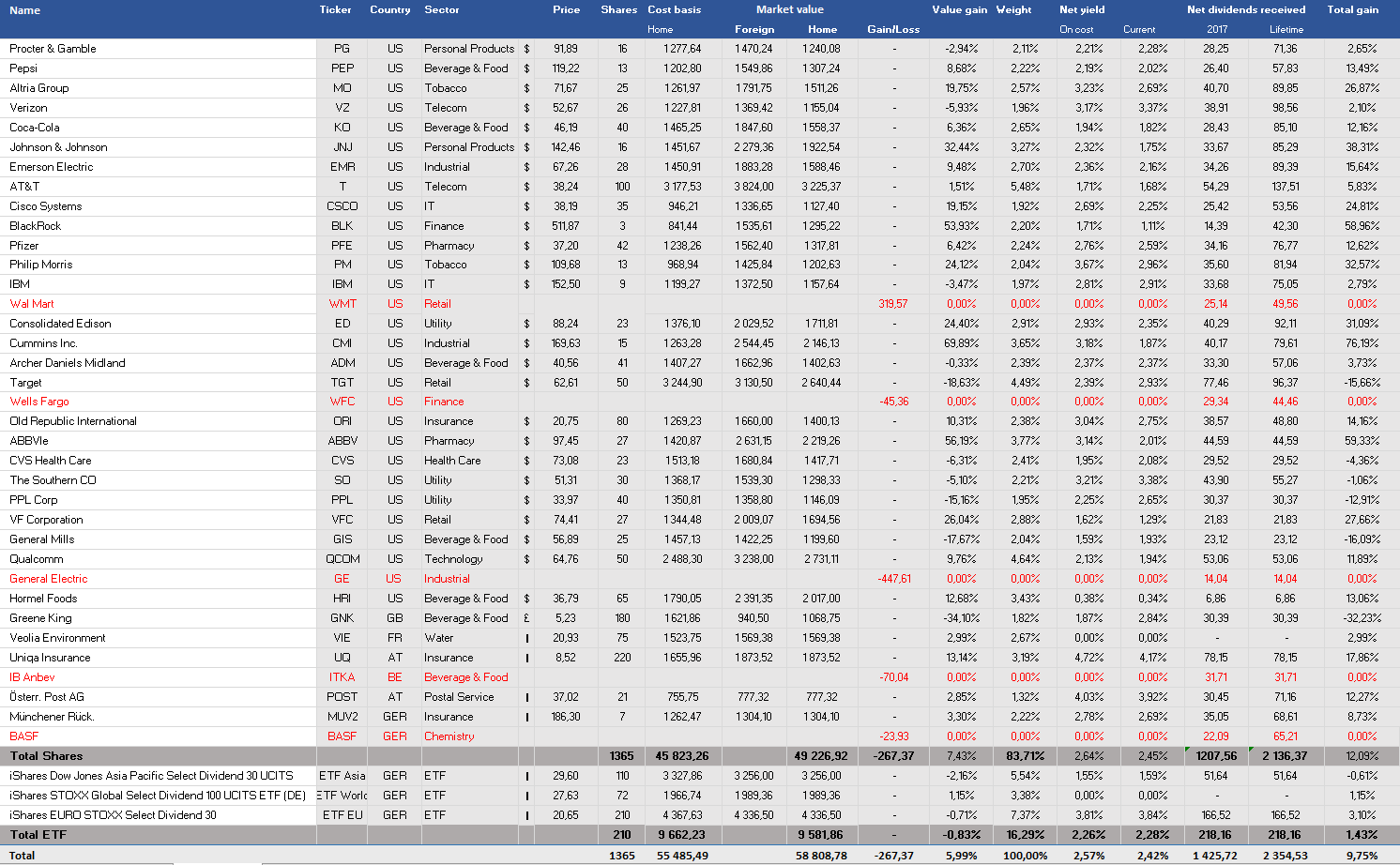

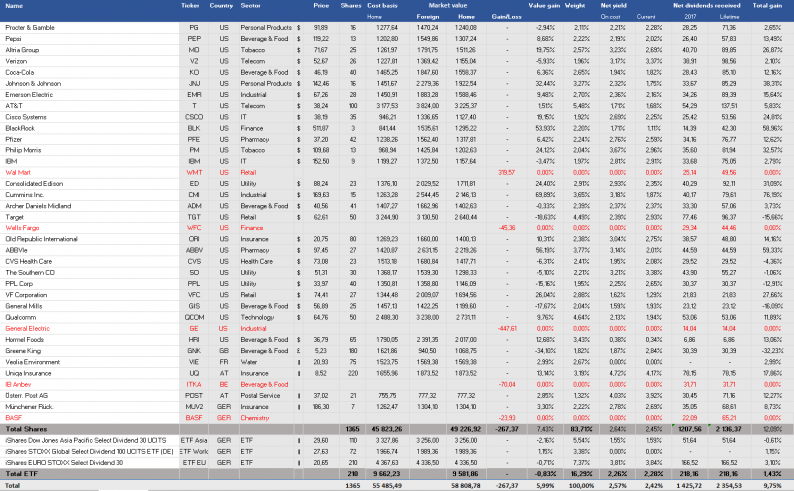

Another month has passed on my dividend income journey and I want to give you a short update on my portfolio for mid-December 2017. Currently, the portfolio has already reached a size of 58 058.12 EUR. The portfolio contains 31 companies and three ETF’s so far.

Changes in my Portfolio

It is the first time that I sold a couple of companies. I sold the following companies:

But at the same time, I also invested in two additional ETF’s and bought more shares of AT&T. The half of the additional cash I got from the Wal Mart sell I have invested into IOTAS but more about that later :).

So I am still invested 31 companies which is already a lot, and I still have a couple of companies on my watch list :).

Overview Portfolio

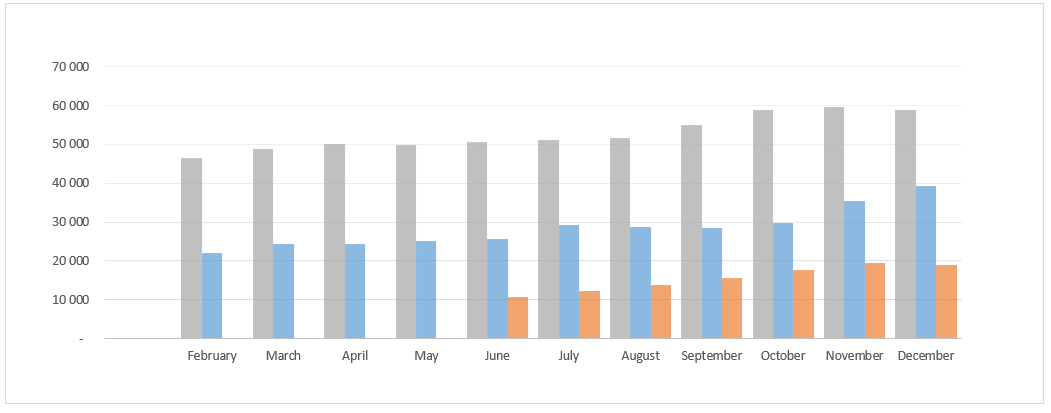

Development Portfolio 2015 – 2017

As you can see I managed it that my portfolio is growing on a monthly basis and compared to November 2015 it has almost triple the size now and it generates a decent dividend income.

Currently, my full-year dividend income is 1 601.43 EUR. Due to my additional investments into the two ETF’s and AT&T I have managed it that my dividend income could increase significantly compared to the last month.

Leave A Comment