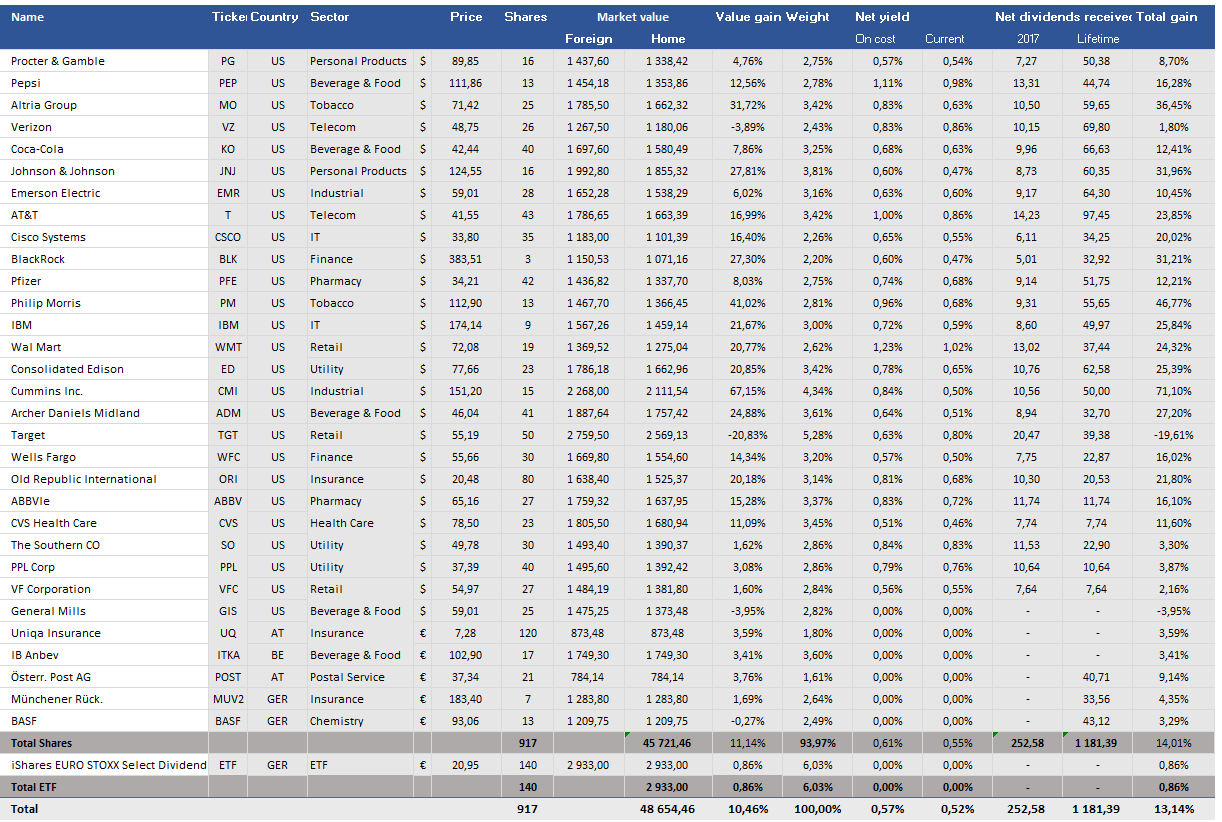

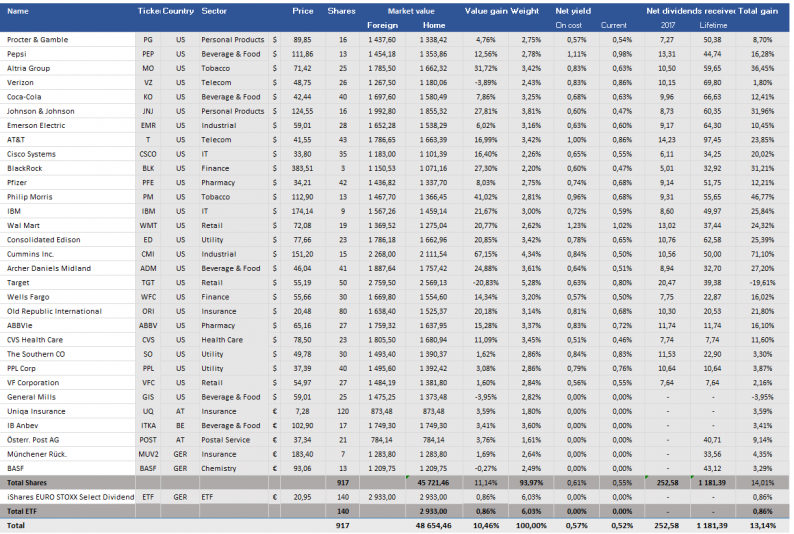

Another month has passed on my dividend income journey and I want to give you a short update on my portfolio in March 2017. Currently the portfolio has already reached a size of 48 654.46 EUR. The portfolio contains of 31 companies and one ETF so far.

Investments

In March I added the following ETF to my portfolio:

This investment will now add about 133 EUR to my annual dividend income. Furthermore I am also very happy that I now finally have an ETF in my portfolio. As I already planned it a long time ago. Currently it is also my largest position in my portfolio followed by Target.

Overview Portfolio

I also calculated my overall performance of my portfolio for the last 12 months, including dividends after tax and of course considering the investments. For the dividend investor the performance is not so important but it is still nice to see that you are not doing so bad :).Compared February the performance of my portfolio was not so good afterall.

The detailed positions of my portfolio can be found here.

How was your development of the portfolio or any other thoughts about my portfolio?

Leave A Comment