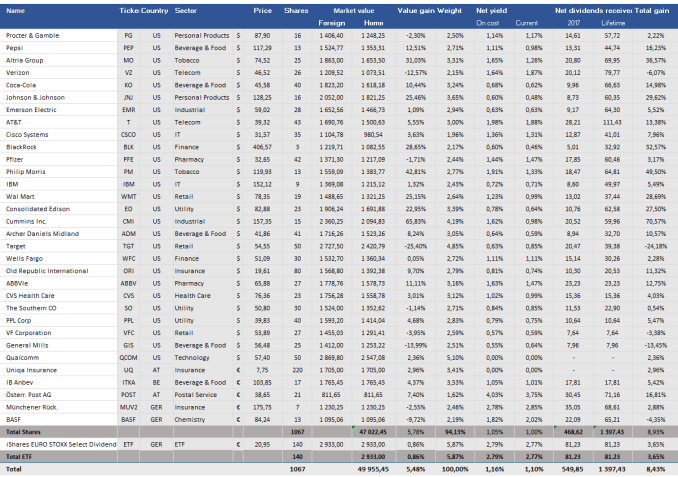

Another month has passed on my dividend income journey and I want to give you a short update on my portfolio in May 2017. Currently the portfolio has already reached a size of 49 955.45 EUR. The portfolio contains of 32 companies and one ETF so far.

Investments

In May I added the following company to my portfolio:

This investment will now add about 49 EUR before tax to my annual dividend income. All in all I now have 220 shares of Uniqa in portfolio.

Overview Portfolio

I also calculated my overall performance of my portfolio for the last 12 months, including dividends after tax and of course considering the investments. For the dividend investor the performance is not so important but it is still nice to see that you are not doing so bad :).Compared March the performance of my portfolio was not so good afterall. The main reason for it is that USD is currently weaker than in the months before.

Nevertheless as long as the dividends are coming in, the portfolio performance is not that important to me. But I am also of course a little curious how I do compared to the market :).

How was your development of the portfolio or any other thoughts about my portfolio?

Leave A Comment