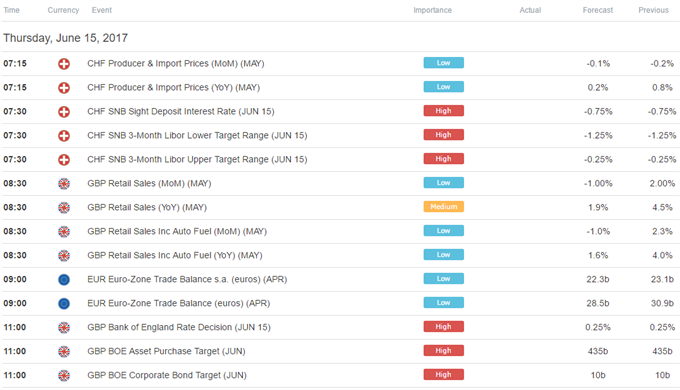

Monetary policy announcements from the Swiss National Bank as well as the Bank of England are in focus in European hours. Neither announcement seems likely to provide truly lasting directional guidance for its respective currency however.

The SNB will likely leave its negative-rate regime unchanged and repeat the now-familiar threat to intervene in FX markets “as necessary”. The shock outcome of the UK election and deepening US political uncertainty will probably keep accommodative policy in place even as inflation edges higher.

Turning to the BOE, worries about deepening Brexit-related uncertainty after last week’s vote stripped the Conservatives of their parliamentary majority will probably keep the MPC sidelined. Still, the British Pound may edge down if previously hawkish Kristin Forbes withdraws her vote favoring a rate hike.

Risk aversion may also make its mark. European and US stock index futures are pointing sharply lower after reports that US President Trump is personally under investigation for possible obstruction of justice. Lingering negativity may offer support to the perennially anti-risk Japanese Yen.

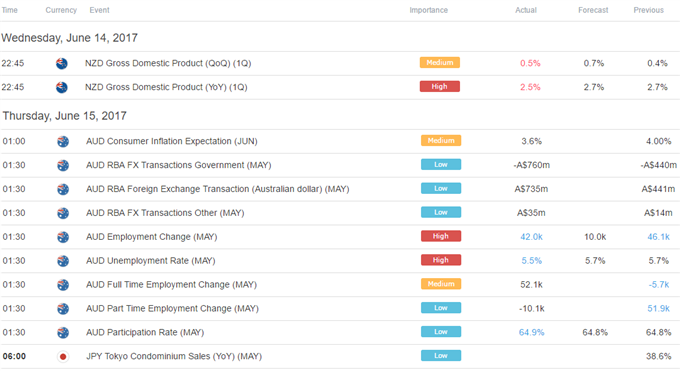

The New Zealand Dollar underperformed in Asian trade, dropping after a disappointing first-quarter GDP report. By contrast, the Australian Dollar pushed upward after May’s labor market statistics proved to be far rosier than consensus forecasts envisioned.

Need help turning your market ideas into an actionable strategy? Check out our trading guide.

Asia Session

European Session

** All times listed in GMT. See the full DailyFX economic calendar here.

Leave A Comment