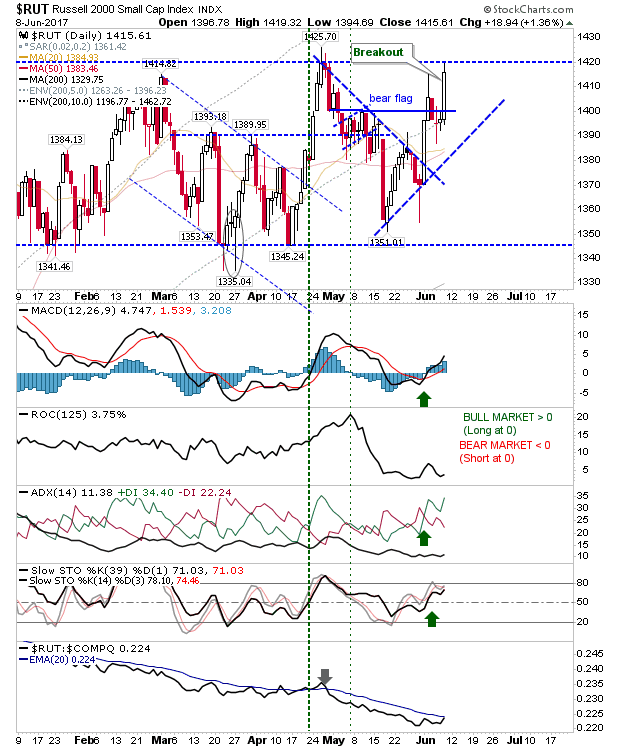

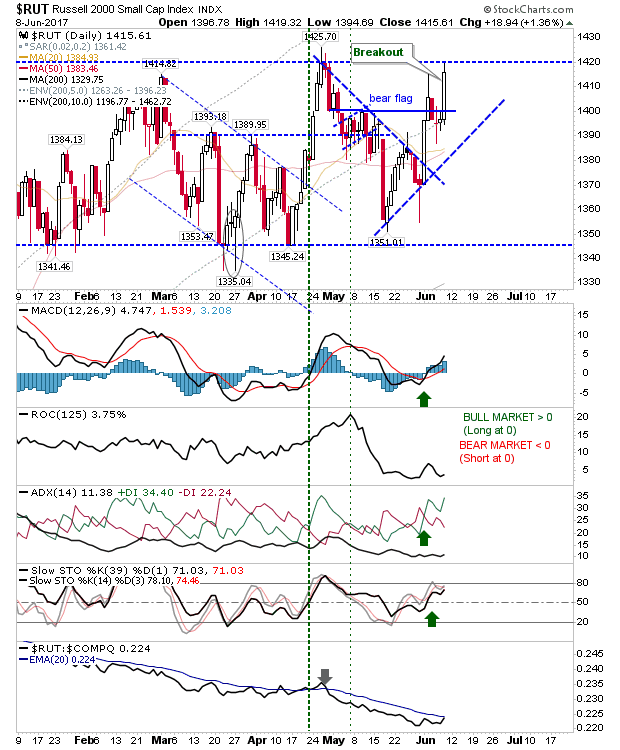

There wasn’t much to attract interest but the Russell 2000 managed to stick its head above the parapet with a solid gain. The Russell 2000 was left just shy of challenging trading range resistance. Other indices are trading in a tight range which builds tension for a reactionary move; given what’s happened in Small Caps, a breakout higher is perhaps favored.

The Russell 2000 cleared inner resistance of the ‘bear trap’ and brought the index to trading range resistance. Tomorrow, watch for a consolidation at 1,420 before the Russell 2000 pushes higher.

The Dow Jones had looked ready to follow with a new confirmed breakout, but it gave up ground by the close of business. Lead supporting technicals are net bullish with the exception of relative performance against the Nasdaq 100.

The S&P traded an indecisive spinning top on higher volume accumulation. However, while price action was muted relative performance against Small Caps has taken a sharp move south; money is rotating out of safety-first Large Caps to more speculative Small Caps – a move which favours bulls and long-term stock holders.

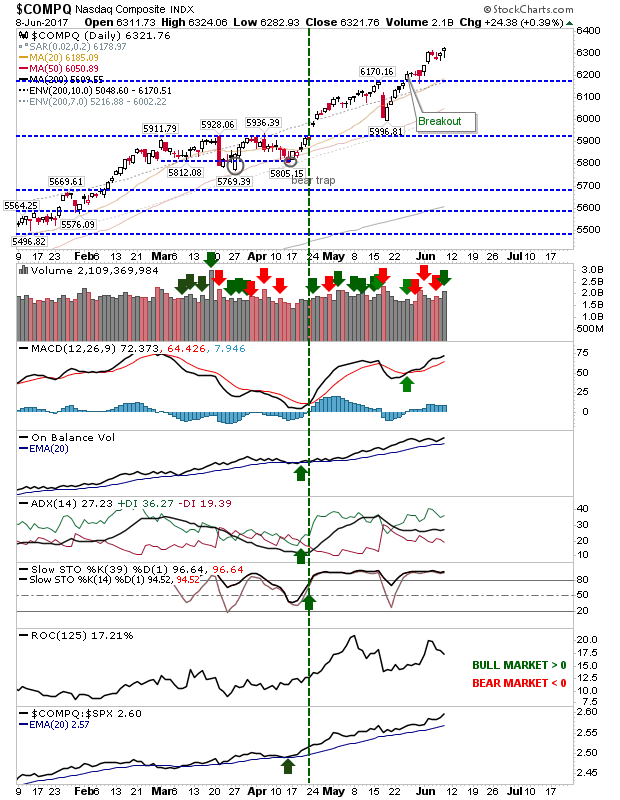

The Nasdaq poked his head to new highs on higher volume accumulation. While it technically could be viewed as a breakout there wasn’t really enough momentum to rate it as such. Relative performance remains strong.

Markets are well placed to follow up on the gains generated by the Russell 2000 and generate follow up breakouts in Large Caps and Tech – not to mention – a trading range breakout in the Russell 2000.

Leave A Comment