Everybody who’s owned gold and silver mining shares through a couple of cycles has their favorite story of the stock that took off and ran away. There was Glamis Gold, which rose from $1 to $40 in the space of a few years before selling out to Goldcorp. And Silver Wheaton, which soared from $3.45 in 2008 to over $40 in 2011. And many, many more.

That’s how mining shares — which are, as the industry likes to say, leveraged plays on gold and silver — behave when the underlying metals start to rise. And you only need to find and ride a few such moonshots to justify a lifetime of obsessing over your investments.

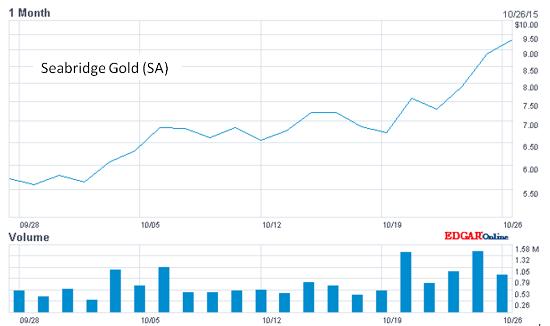

Now, after a brutal and interminable bear market, a few of the better miners and streaming companies are starting to show signs of that famous upside potential. Three examples:

There’s no way to know whether this is a head fake in an ongoing bear market or the start of another epic rise — which, this time, we don’t want to miss! But when that epic rise does come, its initial stage will look like these charts. So the current action at least bears watching.

Leave A Comment