In many pursuits, newcomers are so far removed from the experts that it is difficult to learn from the best.

This is not the case with investing. Investors can easily learn from (and imitate) the investment decisions of successful institutional investors – the best in the business.

One example of this is Prem Watsa.

As the Chief Executive Officer of Fairfax Financial Holdings Ltd. (FRFHF), a Canadian insurance company, Watsa is the portfolio manager for an impressive sum of insurance float. About $1.1 billion of this is invested in publicly-traded common stocks.

This article will analyze Prem Watsa’s dividend stock investment portfolio in detail.

Prem Watsa’s Investment Style

Prem Watsa is the Chairman and Chief Executive Officer of Fairfax Financial Holdings Ltd, a Canadian insurer and investment manager.

Fairfax’s operations are remarkably similar to those of Berkshire Hathaway (BRK-A) (BRK-B). The company’s insurance operations are consistently profitable (as measured by the combined ratio), which means that Fairfax is consistently generating useable capital known as insurance float.

I could give an adequate explanation of insurance float, but I’ll instead refer to Warren Buffett’s – the master of generating wealth via insurance float – explanation of insurance float from Berkshire Hathaway’s 2007 Annual Report.

“Insurance float – money we temporarily hold in our insurance operations that does not belong to us – funds $59 billion of our investments. This float is “free” as long as insurance underwriting breaks even, meaning that the premiums we receive equal the losses and expenses we incur. Of course, insurance underwriting is volatile, swinging erratically between profits and losses. Over our entire history, however, we’ve been profitable, and I expect we will average breakeven results or better in the future. If we do that, our investments can be viewed as an unencumbered source of value for Berkshire shareholders.”

Fairfax’s insurance float operates in precisely the same manner.

Prem Watsa’s excellent capital allocation skills and his use of insurance float have led him to be called the “Canadian Warren Buffett”.

Aside from the use of float and strong investment returns, Watsa’s investment style is notably different than Buffett’s in many ways.

First of all, Prem Watsa is active outside of the equity markets. While Warren Buffett is not known for investing in bonds, Watsa had (until recently) a very large stake in U.S. government bonds. He trimmed back this stake after the outcome of the U.S. Presidential Election – when he became more bullish – but he still owns short-term government bonds to this day.

Secondly, Prem Watsa actively engages in the derivatives markets.

Financial derivatives are securities that derive their value from the price of some other security (called the ‘underlying’). The most common examples of financial derivatives are call options and put options.

Watsa, however, prefers inflation-linked derivatives that will pay cash to Fairfax if major economies experience systemic deflation (a major sign of economic weakness).

Watsa gave a succinct explanation of these inflation-linked derivatives in Fairfax’s 2010 Annual Report:

“Say the consumer price index in the U.S. was 100 when we purchased this contract. In ten years’ time, if the CPI index is above 100 because of cumulative inflation, then our contract is worthless. On the other hand, if the index is below 100 because of cumulative deflation, then the contract will have value based on how much deflation we have had. If, for instance, the index is at 95 because of a cumulative 5% deflation over 10 years, the contract at expiry would be worth 5% of the notional value of the contract. That’s how it works!”

Watsa has also used financial derivatives to reduce his net equity exposure without having to hold cash, although he has reduced these equity hedges in recent months (similar to his sale of the majority of his U.S. corporate bonds).

Watsa’s investment in financial securities is highly unlike his American counterpart Warren Buffett. Buffett – and by extension, Berkshire Hathaway – has avoided derivatives in the past.

Table of Contents

Prem Watsa’s Fairfax Financial currently owns 16 dividend paying stocks. You can skip to analysis on each of these stocks by clicking on the links below. Note: This article covers only dividend stocks, so Watsa’s largest positions – Blackberry (BBRY) – is excluded from this list since it does not pay a dividend.

National Oilwell Varco, Inc. (NOV)

Dividend Yield: 0.6%

Adjusted Price-to-Earnings Ratio: N/A (negative earnings)

Percent of Prem Watsa’s Portfolio: 0.0% (very small)

Fairfax Financial owns 6,400 shares of National Oilwell Varco with a market value of $240,000. It is a relatively small position in Watsa’s investment portfolio.

National Oilwell Varco is a leading supplier of components and equipment for the oil and gas industry.

The company operates in three main segments:

The company’s revenues are approximately evenly distributed across land and offshore drilling.

Source: NOV Presentation at the Scotia Howard Weil 2017 Energy Conference, slide 7

NOV has invested heavily in predictive analytic to improve the experience of its end customers.

The slide below shows an example of the company predicting the maintenance of a regulator valve, and delivering the spare part accordingly.

Source: NOV Presentation at the Scotia Howard Weil 2017 Energy Conference, slide 18

As a services company, finding ways to minimize downtime (such as the method displayed in slide above) will improve productivity and efficiency. This will improve margins and other financial efficiency metrics.

Indeed, National Oilwell Varco’s financial numbers are strong. The company generates the highest free cash flow as a proportion of revenues out of its ‘Big Four’ peer group.

Source: NOV Presentation at the Scotia Howard Weil 2017 Energy Conference, slide 41

Looking ahead, many investors are curious if we are on the brink of the next economic recession.

If this is indeed the case, National Oilwell Varco is well-poised to thrive from a financial perspective.

The company sports a BBB+ investment-grade credit rating.

National Oilwell Varco also has $1.4 billion of cash on hand and total current liquidity of $5.9 billion (this compares favorably to the company’s $13.9 billion market capitalization).

Source: NOV Presentation at the Scotia Howard Weil 2017 Energy Conference, slide 43

National Oilwell Varco appears to be a turnaround play in Prem Watsa’s portfolio – the stock traded for as high as $86 in 2014 and now trades at $36.16.

This drop in stock price has been accompanied by a reduction in earnings. The company reported negative earnings-per-share for fiscal 2016. Accordingly, it cannot be meaningfully analyzed using the price-to-earnings ratio.

Low earnings have impacted the dividend of National Oilwell Varco. The company cut its dividend from $0.46 to $0.05 last year, and the current forward dividend yield is 0.6%.

Investors should be wary of this company – its large net losses for fiscal 2016 will lead to bankruptcy unless performance improves soon.

Leucadia National Corporation (LUK)

Dividend Yield: 1.0%

Adjusted Price-to-Earnings Ratio: 76.9x

Percent of Prem Watsa’s Portfolio: 0.6%

Prem Watsa holds 300,000 shares of the Leucadia National Corporation with a market value of $7.0 million.

The Leucadia National Corporation is a conglomerate engaged in a wide variety of businesses, including telecommunications, healthcare, manufacturing, and banking.

Because of its diverse business mix, Leucadia has been called the ‘baby Berkshire Hathaway‘ by some investors.

The companies diverse holdings can be seen in the following diagram.

Source: Leucadia 2016 Investor Presentation, slide 2

Leucadia has grown significantly over the years.

The number of owned business has increased 80% since 2012. Further, the company has a much greater degree of diversification than it did in the past.

Leucadia’s risk metrics have also improved, with the company making progress in its liquidity ratio and leverage ratio.

Source: Leucadia 2016 Investor Presentation, slide 3

Leucadia’s largest (and most important) holding is Jefferies, a global investment bank and securities firm. Jefferies operates in the following segments:

When most people think of an investment bank like Jefferies, they become concerned about risk.

However, Jefferies benefits from an attractive long-term debt profile. The subsidiary’s $5.2 billion in long-term debt has a weighted average maturity of ~8 years, and the company makes good use of convertible notes.

Source: Leucadia 2016 Investor Presentation, slide 46

Right now, Leucadia is not attractively valued. The company reportedearnings-per-share of $0.34 for fiscal 2016, and its current stock price of $26.15 represents a price-to-earnings ratio of 76.9. This price is very elevated and reminiscent of dot-com bubble valuations.

Stocks with such high valuation cannot sustainably have high dividend yield. This holds true for Leucadia.

Leucadia currently pays a quarterly dividend of $0.0625, or $0.25 annually. This represents a paltry dividend yield of 1.0%.

Leucadia’s sky-high valuation and low dividend yield would lead to a poor ranking using The 8 Rules of Dividend Investing. Investors can find higher dividend yields and more attractive valuations elsewhere.

The Valspar Corporation (VAL)

Dividend Yield: 1.1%

Price-to-Earnings Ratio: 25.8x

Percent of Prem Watsa’s Portfolio: 0.06% (very small)

Fairfax Financial owns 6,200 shares of the Valspar Corporation with a market value of $643,000.

Valspar is a global leader in the paint and coatings industry. The company offers traditional and value-added products to consumers in more than 100 countries.

For Valspar shareholders, the primary current event of interest is the pending acquisition by Sherwin-Williams (SHW), which was originally announced in March of 2016.

The acquisition is expected to drive growth through synergies between the two businesses and will be immediately accretive to the proforma company’s earnings-per-share.

More details about the benefits of the acquisition can be seen below.

Source: Valspar & Sherwin-Williams Merger Presentation, slide 1

The acquisition is being completed on an all-cash basis.

Existing Valspar shareholders will receive $113 in cash per Valspar share, which represented a 41% premium to the average stock price leading up to the announcement. Further, this represented a 28% premium to the all-time high closing price.

Valspar is currently trading at $112.44 per share. The razor-thin arbitrage spread of $0.56 indicates that the markets have a high degree of confidence that this acquisition will close.

More details about the mechanics of the transaction can be seen below.

Source: Valspar & Sherwin-Williams Merger Presentation, slide 2

The proforma company will benefit from being the undisputed leader in the global paints and coatings industry, with higher annual sales than the current industry leader – PPG Industries (PPG).

The global paints and coatings industry will remain highly fragmented even after the second (Sherwin-Williams) and fifth (Valspar) largest companies merge. This means that Sherwin-Williams can still pursue opportunistic acquisitions to drive the growth of its business.

Source: Valspar & Sherwin-Williams Merger Presentation, slide 5

The proforma company will also be much more diversified.

Currently, Sherwin-Williams generates a very large proportion of its revenues from its Paint Stores segment.

The acquisition will reduce the proforma company’s reliance on this retail segment.

Source: Valspar & Sherwin-Williams Merger Presentation, slide 6

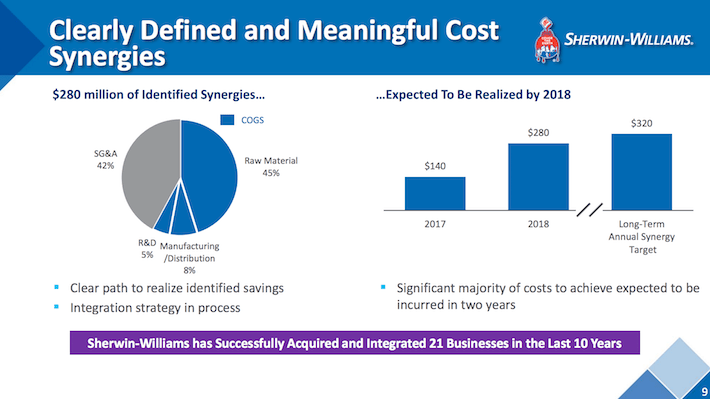

The new Sherwin-Williams will also benefit from significant cost synergies.

Valspar and Sherwin-Williams currently operate very similar business models. It makes sense, then, that the proforma company will be able to eliminate duplicate roles and become leaner as a result.

The company’s expected cost synergies can be seen in the following diagram.

Source: Valspar & Sherwin-Williams Merger Presentation, slide 9

The deadline for the closure of the Valspar has been extended to June 21, and Sherwin-Williams management stated on their first quarter conference callthat they expect the acquisition to be finalized before then.

If the transaction closes on precisely June 21, the current $0.56 arb spread represents an IRR of less than 1%. Thus, investors should not view Valspar as a merger arbitrage opportunity.

Leave A Comment