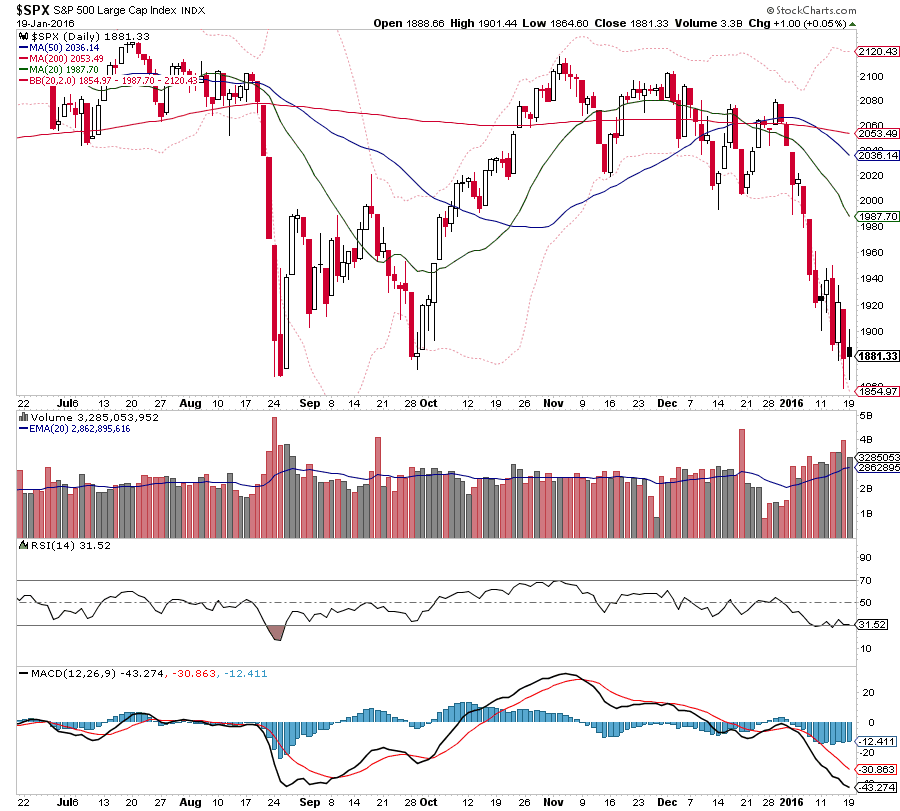

Coming into the week big struggle for many market participants was this: the conditions seemed damn obvious for a short term rally, but the intermediate trend lower is the strongest to the downside since 2008. The market is just unable to stop the bleeding.

The S&P 500 posted an inside day Tuesday. Watch which way it breaks. It appears to be breaking lower overnight. If so, all the confident dip buyers from Friday, the 3 day weekend and Tuesday are now trapped.

Despite the SPX inside day, the NYSE stock only advance-decline line keeps hitting new lows.

Although SPX and the NASDAQ have held the fall lows, broader markets such as the NYSE Composite and Russell 2000 have also led the market to new lows.

For the last week the market has been drastically oversold and hasn’t been able to find any sustainable bounce. During this time, aggressive put buyers have kept the CBOE SKEW index at a very high level.

It’s smart to be prepared for a crash like event as the markets are moving aggressively with ease.

Asset Allocation is on the edge of a MAJOR shift. Bonds are ready to outperform stocks in a big way over the next few months.

Major support is being breached in the Consumer ratio. A 4 year trend appears to be ending.

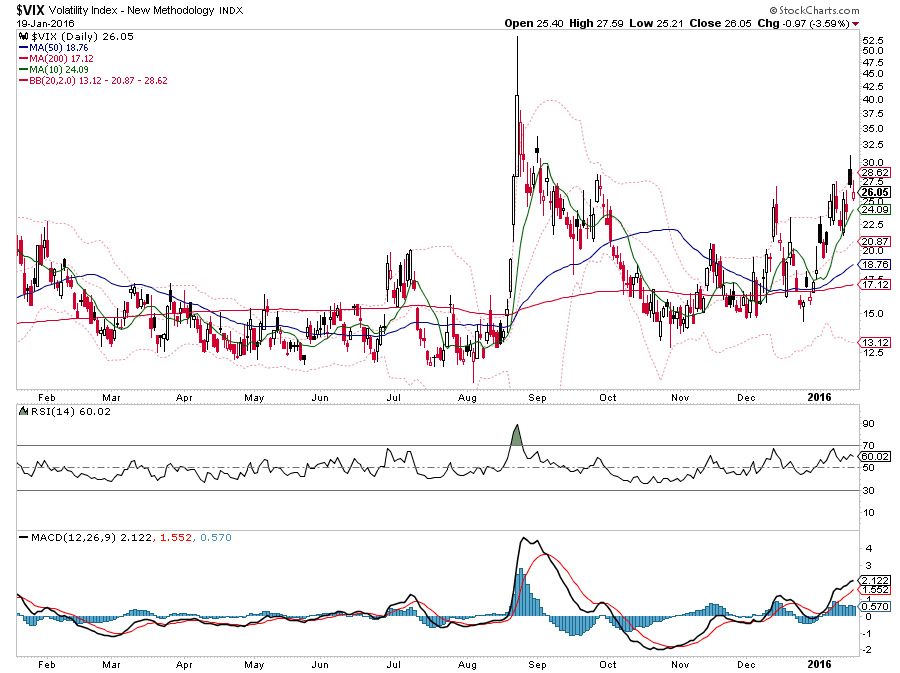

With all these scary charts, you’d think fear was high. Well, it’s not. The VIX is printing 26. 26! There is little if any fear out there.

It’s just smart to prepare for the worst in these conditions.

Trade ’em safe!

Leave A Comment