In the first part of the Preparing for THE Bottom series, we emphasized the need to be sure to stay alert and focused in the precious metals market, even though it may not appear all that interesting. We argued that preparing for the big moves in gold that are likely to be seen later this year should prove extremely worth one’s while. In the second part of the series, we discussed when, approximately, one can expect the key bottom in gold to form (reminder: this winter appears a likely target) and in the third part of the series, we discussed one of the confirmations that could indicate that the final bottom is in or at hand – the gold to silver ratio. The latter is not the only important ratio that one needs to keep in mind and in today’s article, we’re going to discuss two additional ones: the one based on gold and the bond market and a second one, which includes gold stocks and gold. Both ratios add to the clarity regarding the upcoming bottom and they could be used as confirmations that the bottom is indeed in or at hand.

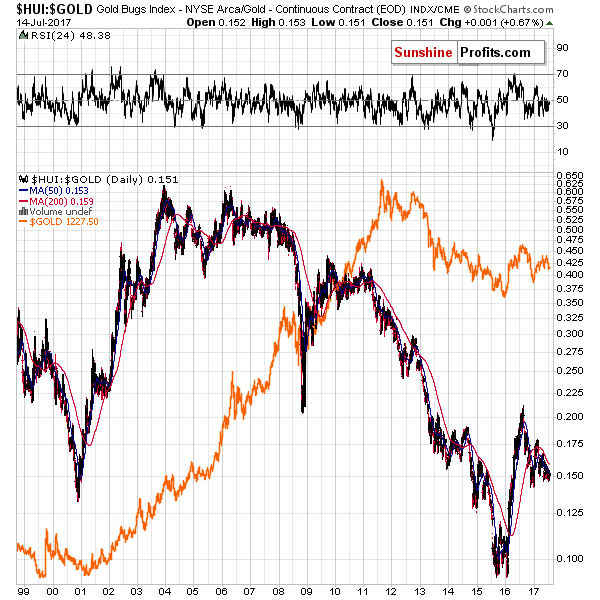

Let’s start with the gold stocks to gold ratio (charts courtesy of StockCharts).

There are exceptions to this rule, but in general, the big upswings in the ratio are seen along with big rallies in the prices of gold. In other words, during and, at times, before big moves, gold stocks tend to lead the way up. The opposite can be seen in the case of the big downswings.

Before moving further, please note that from the very long-term point of view, both the gold/gold stocks link and the price of gold itself are not very closely connected and gold stocks appear to have lost a part of their gleam. This is true to a large extent and two important reasons behind this are the increase in costs (please note that gold stocks were doing particularly well until crude oil broke decisively above $35 in 2004) and the increase in popularity of investment/trading vehicles that combine the ease of investment with leverage (leveraged ETFs), which vehicles make the unclear leverage that gold stocks provide less appealing.

Leave A Comment