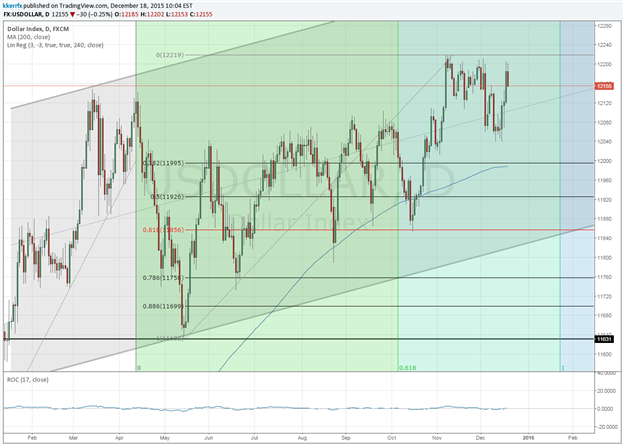

The USD has held up relatively well so far this month. Remember December is one of the worst months for the dollar from a seasonality perspective so the fact that the FXCM USDollar Index (basked of USD versus EUR, JPY, GBP and AUD) is pretty much unchanged this far into month is probably a good sign. Obviously, there is a lot of time left before year-end so I would not completely write off the possibility that negative seasonal forces reassert themselves before then, but time is ticking. January, on the other hand, is historically a very strong month for the Greenback so if it continues to hold up here there is probably a decent chance that we could see a strong move to start the year.

The 12,220 level in USDollar has obviously proven pretty sticky. A weekly close above there is likely needed to set the stage for a more important move higher. The month-to-date lows around 12,040 are obviously a key near-term pivot as weakness below this level would trigger a minor topping pattern and warn that the last couple of weeks of the year could get rocky. However, it would probably take a move under the 200-day moving average and the 38% retracement of the May – November advance around 12,000 to really turn the technical picture negative.

Leave A Comment