Written by Crypto Guru

Price analysis in the cryptomarkets is getting somewhat trickier with each passing day, particularly with a series of external factors like regulatory actions impacting marketing sentiments.

designwebjae / Pixabay

Though early investors in Bitcoin have benefited from the ‘buy and hold’ approach, later entrants have seen the wild price fluctuations in recent weeks as an opportunity to add to their Bitcoin holdings. Many charts indicate that over the past few years, the whales have consistently increased their holdings in Bitcoin. Typically, an average trader uses these price swings to buy at the highs and sell at the lows. There have been many good Samaritans in the cryptoworld, advising people to safeguard themselves from this pitfall. As at mid February, though being aggressive with long positions may not be desirable, is there a short-term bottom emerging now? On that note, here is a break-down of how some of the top altcoins and Bitcoin are positioned at mid February, 2018.

BTC/USD – Price analysis

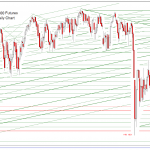

It was expected that Bitcoin would go below its recent lows below its current trendline. However, bulls had a better grip and the bears failed to hammer the price below $8,000. The downtrend line may face resistance and if it manages to claw back above the 20 days EMA, the bulls may succeed in taking the price to the $8,600-9,400 range. Once that is achieved, one should expect a quick rally to $12,000 though it could once again be subjected to resistance at 50 days SMA. Ideally, traders should wait for a price breakout above the $9,500 mark for buying. $7,800 should be the stop loss and the target price should be above $12,000.

Potential of BTC/USD pair failing to get past $9,500

If the BTC/USD pair cannot get past the %9,500 mark, and heads south again, the traders are better of waiting and resisting the temptation to add at the lower levels since any dip below $7,800 could potentially take the price further down to $7,000. Both bearish as well as bullish scenarios become relevant in a price analysis since traders should know how to react in both cases.

Leave A Comment