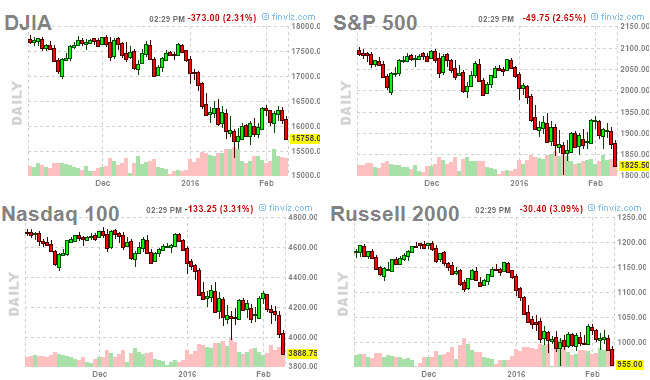

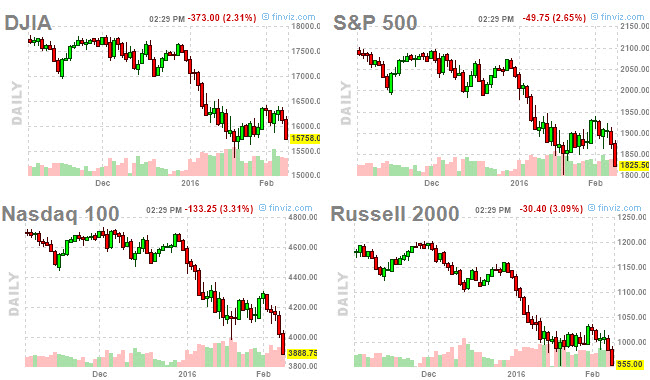

Stock indexes are again in free-fall today. The daily charts of the indexes over the last 3 months looks like this:

Not a very constructive setup, right? You don’t have to be a chart analyst to see what’s happening. The interesting thing is the divergence in the four key indexes: the Dow has not tested its January lows, the S&P 500 and the Russell 2000 are about to test their January lows, while the Nasdaq has already fallen through it.

Where do the indexes go from here? Is there more pain ahead or is the selloff ending here?

Analyst Rob Tovell provides insights into the future direction of the US indexes in today’s 3-minute market update. His forecast was made in December, but it is still actual and, most importantly, one big number is still in play for most of the US indexes.

He provides targets for all 4 indexes. The most important insight for now is the Nasdaq. It could slow the sell off. Why? Because Tovell’s 4th target in the Nasdaq 100 is 3817.00 which is close to be hit today. Learn in this video what exactly it means for the ongoing sell off.

Watch the 3-minute video with price forecasts for the US indexes:

Video Length: 00:03:27

Leave A Comment