Written by Ben Carlson

…Competition and innovation make it very difficult to know whether or not a company will…[be successful with an IPO as] history shows that the majority of IPOs end up underperforming the overall markets. [As the stats below show,] it seems that private investors enjoy all of the spoils in IPO deals while most public stock market investors are left holding the bag.

With SNAP’s early stumble in stock price out of the gate:

it is following a similar path that many other popular tech IPOs have gone down these past few years.

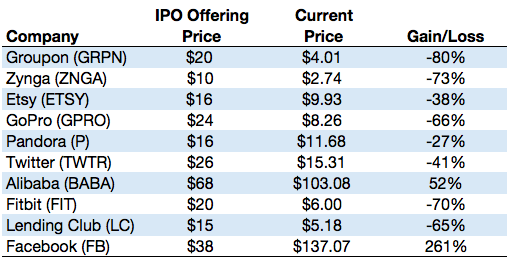

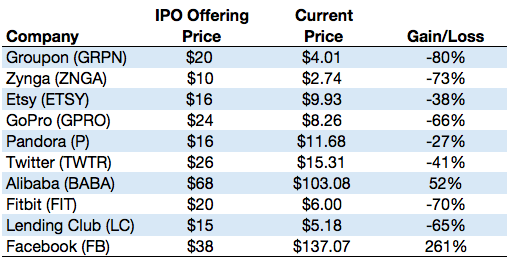

Take a look at a number of other high-profile tech companies that have gone public in recent years along with their subsequent performance:

There have been a number of huge flameouts in this group and only two real winners – Facebook and Alibaba – but these numbers simply show the gains or losses from the offering price. Very few investors actually ever see that offering price because the float is typically so low on these shares and the demand is so high that there’s almost always a huge pop on the first day of trading.

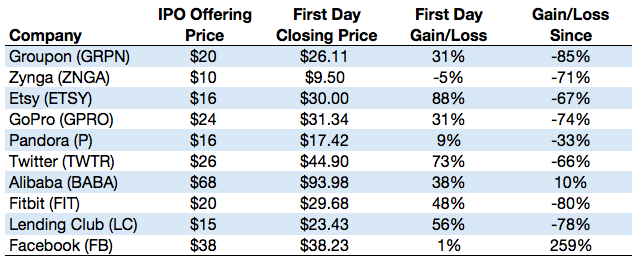

Here’s the same list of companies along with the first-day performance and subsequent performance from the closing price on the first day:

Many of the losses look even worse once you factor in that first day.

The fact that these IPOs have all come during a strong equity bull market is another black eye for the performance of these shares…

Leave A Comment